This feature allows us to decouple invoice generation from E-invoice generation for B2B orders, enabling users to generate a provisional invoice for packing purposes while deferring E-invoice creation until packing is completed and shipment is confirmed. This helps avoid premature E-invoice generation in scenarios where packing spans multiple days and reduces the risk of being unable to cancel an E-invoice if the order gets cancelled later.

Use Case Scenario

In a real warehouse scenario, this feature allows us to manage large B2B orders that require multi-day packing without prematurely generating E-invoices. Warehouse teams can generate an invoice to begin packing and labeling boxes while the order is still in progress. If the order is delayed, modified, or cancelled during the packing window, the E-invoice is not yet generated, preventing compliance and cancellation issues. Once packing is fully completed and the shipment is confirmed, the system generates the final invoice along with the E-invoice, ensuring both operational flexibility and regulatory correctness.

Objective

-

Enable sellers to generate the E-invoice at a later stage, independent of the conventional invoice generation in Uniware.

-

Reduce the risk of invalid E-invoices for orders that are cancelled or delayed during multi-day packing.

-

Provide operational flexibility for warehouse teams handling large B2B orders.

-

Ensure compliance by generating E-invoices only after order packing and shipment confirmation.

Applicability

Version: Standard ,Professional and Enterprise clients

Traceability: None, SKU, Item trace

Configuration

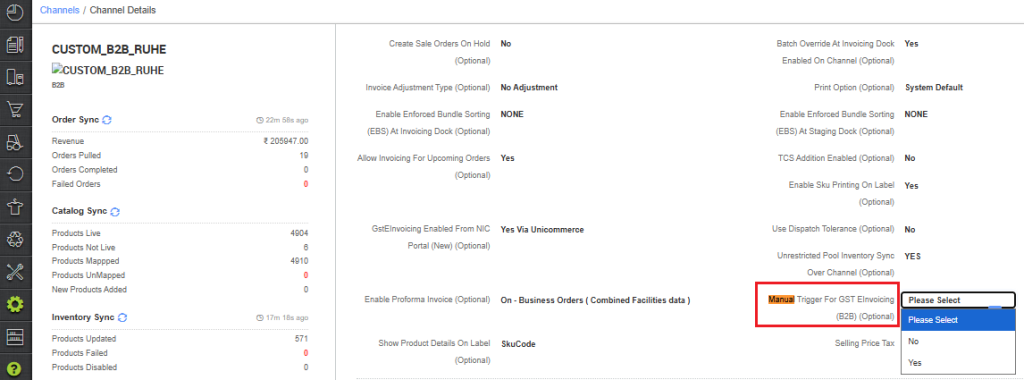

Configuration Name: Manual Trigger for GST E-invoicing (B2B)

Level: Channel Level Setting

Applicable Channels: CUSTOM_B2B

Values:

-

No (Default): E-invoicing is triggered automatically along with invoice generation (current behavior).

-

Yes: E-invoicing will not be triggered automatically. Users must manually initiate E-invoicing after invoice generation.

Definition:

This setting allows sellers to control the timing of E-invoice generation for B2B orders. Selecting Yes enables manual E-invoice generation, providing flexibility for multi-day packing or other scenarios where order details may change before dispatch.

Note’s :

-

This setting is only applicable, in case Channel config – GstEInvoicing Enabled from NIC Portal (New) is enabled

-

The changes is applicable to B2B Orders only that is order_category: B2B

-

In case the Configuration is Yes that only invoice has to be generation, thus we have to make sure that we do not initiate the process of generating the E-invoicing

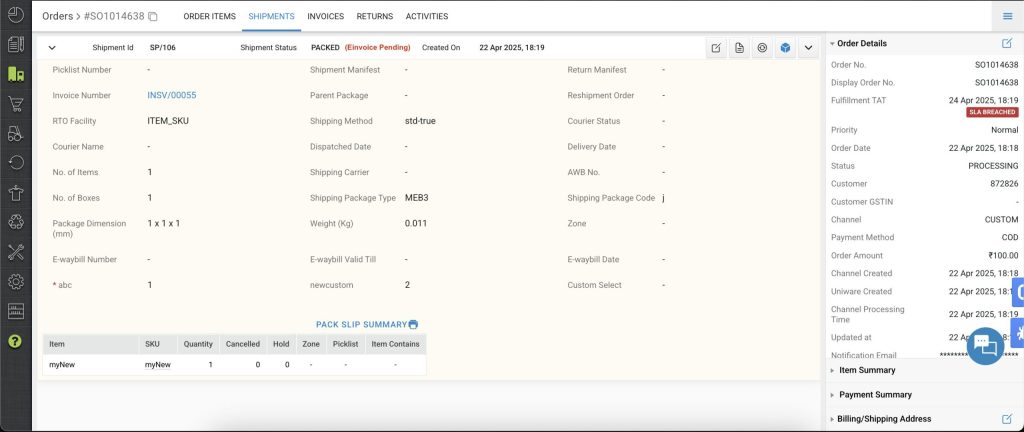

- For shipments where the invoice has been generated but the GST e-invoice is still pending, a flag “GST e-invoice pending” should be maintained at the shipping package level. In such cases, the shipment will remain in the PACKED state, and E-way bill generation should be restricted until the e-invoice is completed.