A new facility Level Config : Taxable Customer Address Type for B2C Orders has been introduced in the edit facility page. This has been done to comply with the government’s new GST taxation norms, that states:

- Taxation for B2C transactions must be based on the end customer’s shipping address rather than the billing address. This applies to all domestic B2C sales, ensuring that tax is levied according to the shipping location.However, the communication of this circular may vary from seller to seller. To implement this, we have introduced this config that allows you to choose between billing and shipping addresses for taxation, depending on whether the government circular has been communicated to you.

- For International / Cross Border Exports from India to any other country order on a b2c transaction , taxation & einvoicing should be on the basis of End-customer’s shipping address.This has been handled at Uniware’s end, and for cross border orders, shipping address will be considered, irrespective of what value has been selected in the config.

Step by Step Procedure:

- Login in your uniware account.

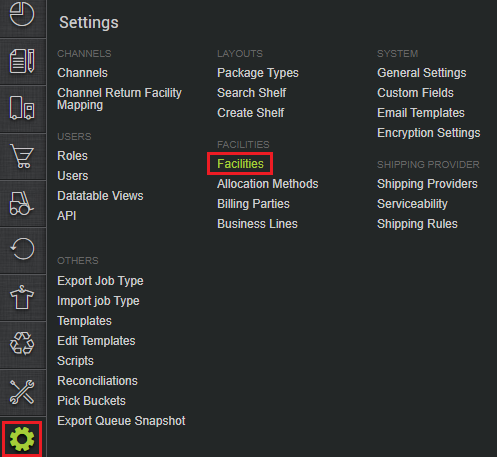

- Navigate to the Settings > Facilities.

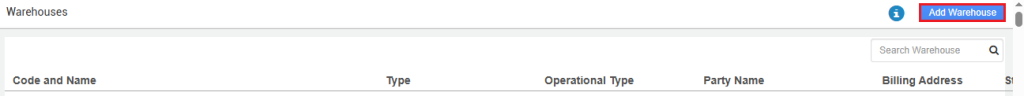

- Click on the Add Warehouse button.

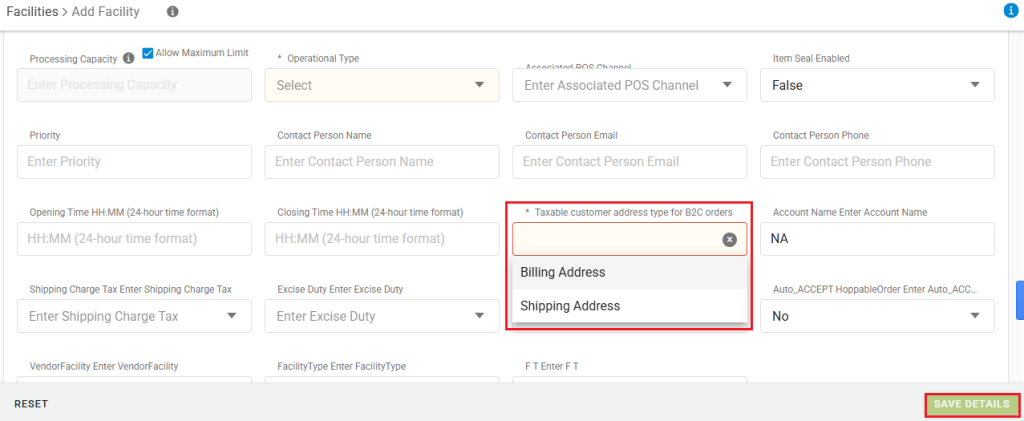

- You will be directed to Add Facility page. Here, you can see the Taxable Customer Address Type for B2C Orders config. This dropdown has 2 values: Billing Address, Shipping Address.

Default Value : Billing Address

- After entering all the required details in this page, click on the Save Details button to proceed.