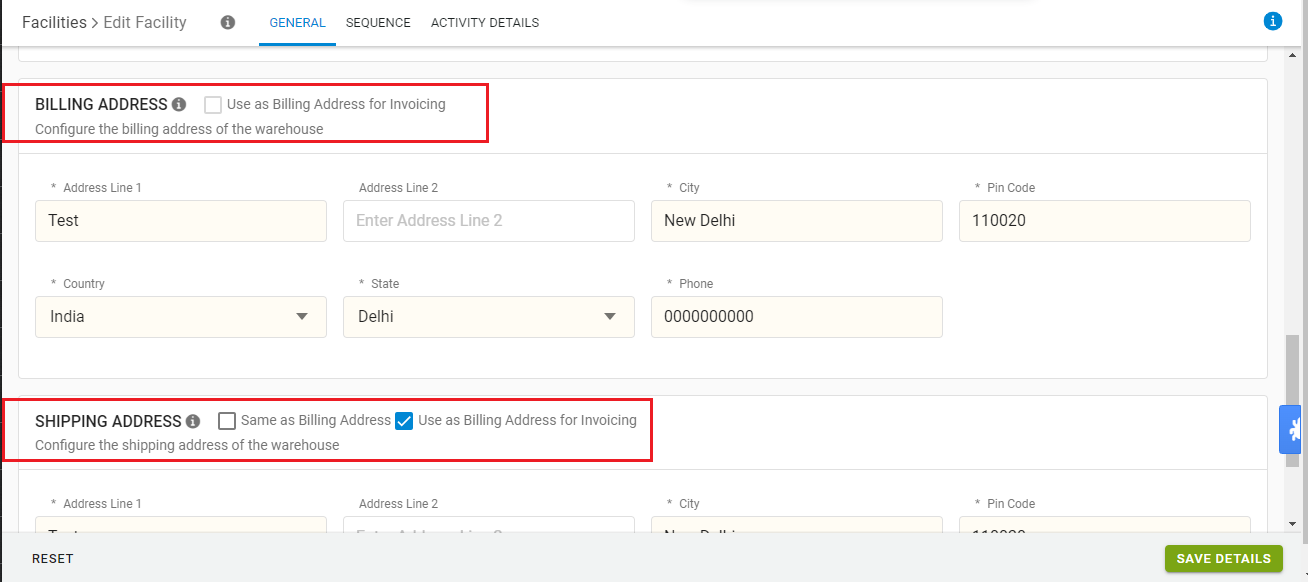

Sellers can configure the billing address for Invoicing from party address for precise tax applicability on invoicing. By using configurable checkbox as Use as Billing Address for Invoicing present at address details in facility or billing party.

Applicability

Version: Standard, Professional and Enterprise

Traceability: None, SKU, ITEM

Visibility:

Addition of configurable checkbox on Facility & Billing Party address fields:

-

Default checkbox ON → for new Tenants ~ Facility / Billing Party = Billing Address

-

Default checkbox ON → for existing Tenants ~ Facility / Billing Party = Shipping Address

-

Validation of GSTIN would be on state code of either of billing address or shipping address selected at Facility / Billing Party

Functionality:

As per checkbox “Use as Billing Address for Invoicing”

-

If selected as ON > On Billing Address

~ Taxation would be between Billing Address of Facility / Billing Party & Billing Address of End-Customer. -

If selected as ON> On Shipping Address

~ Taxation would be between Shipping Address of Facility / Billing Party & Billing Address of End-Customer

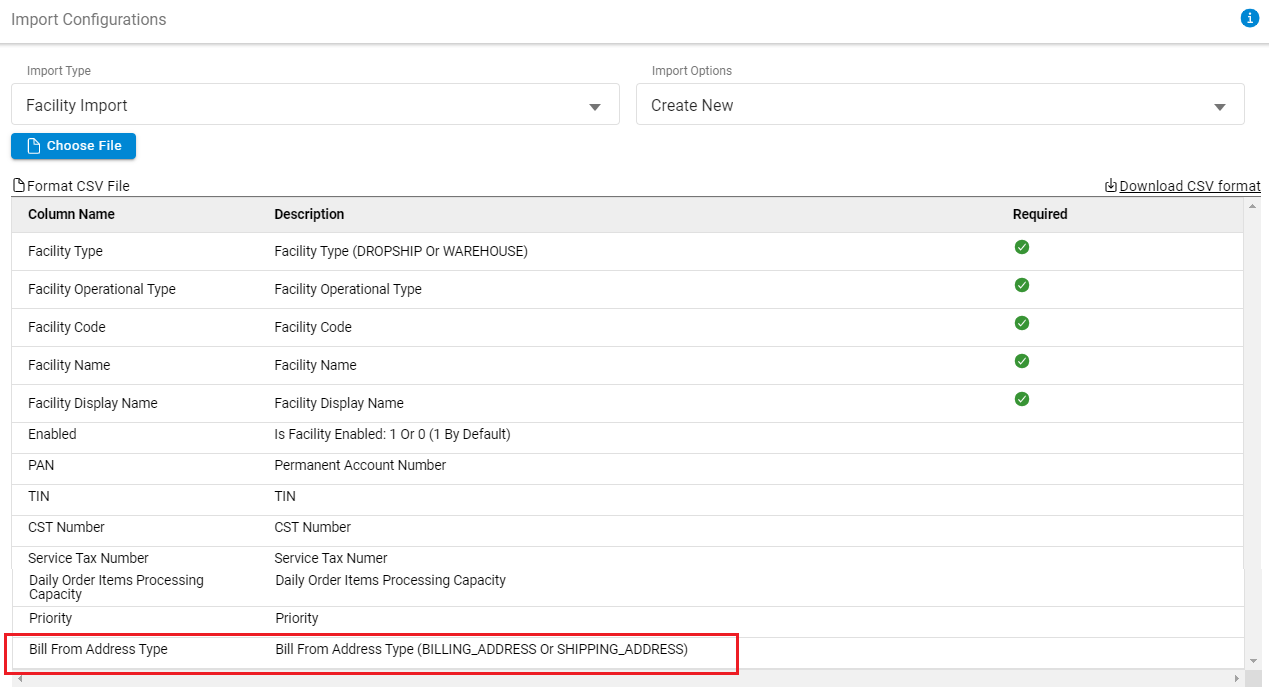

Key change in UC Import file

Import file name: Facility Import

Addition of a key name = Bill From Address

Description = Billing Address / Shipping Address : BILLING_ADDRESS or SHIPPING_ADDRESS ( Refers to used whether Billing Address or Shipping Address for invoicing)

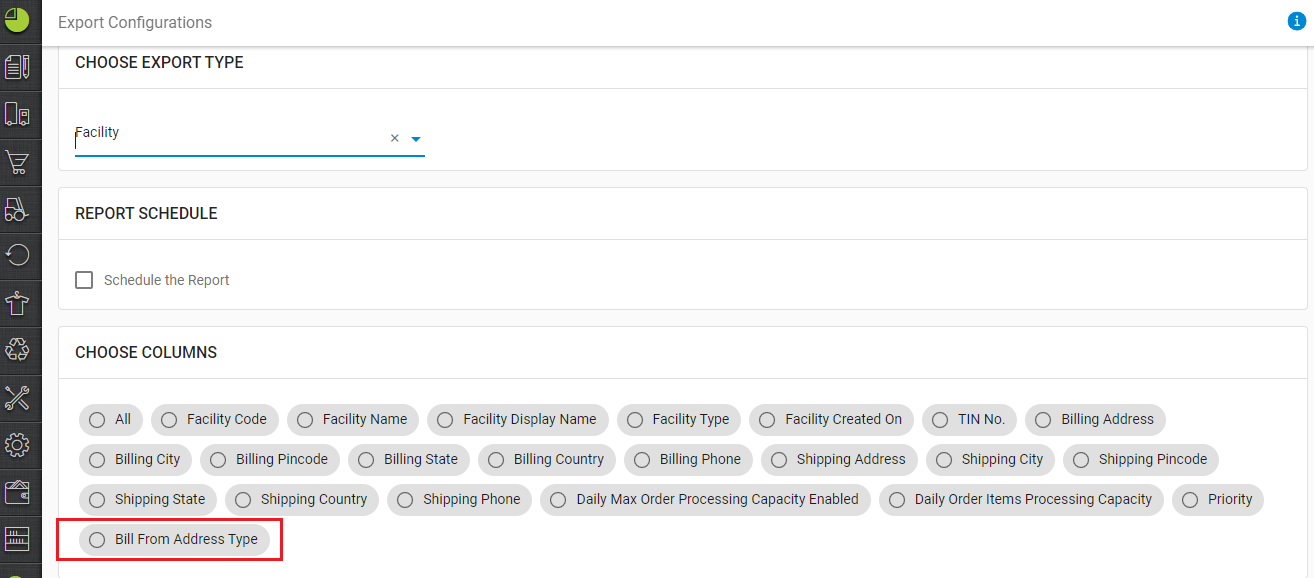

Key change in UC Export file

Import file name: Facility

Addition of key name = Bill From Address

Description = Value = BILLING_ADDRESS or SHIPPING_ADDRESS ( Refers to check whether Billing Address is being used or Shipping Address is being used for invoicing)

Impacts:

Impacts can be applicable to the following functionality/features.

- Sale Invoice

- Ewaybill

- Einvoice

- Gatepass

2724429829 U11417N P2471R