Applicability

Version: Standard, Professional and Enterprise

Traceability: None, SKU, ITEM

The facility details can be updated because of the following reasons :

- To add New key values in current facility details which were not added earlier.

- To update a few key values which are no longer operational. E.g. Company Logo, Signature or Address details.

Note: There is no provision to delete a facility in Uniware.

Procedure

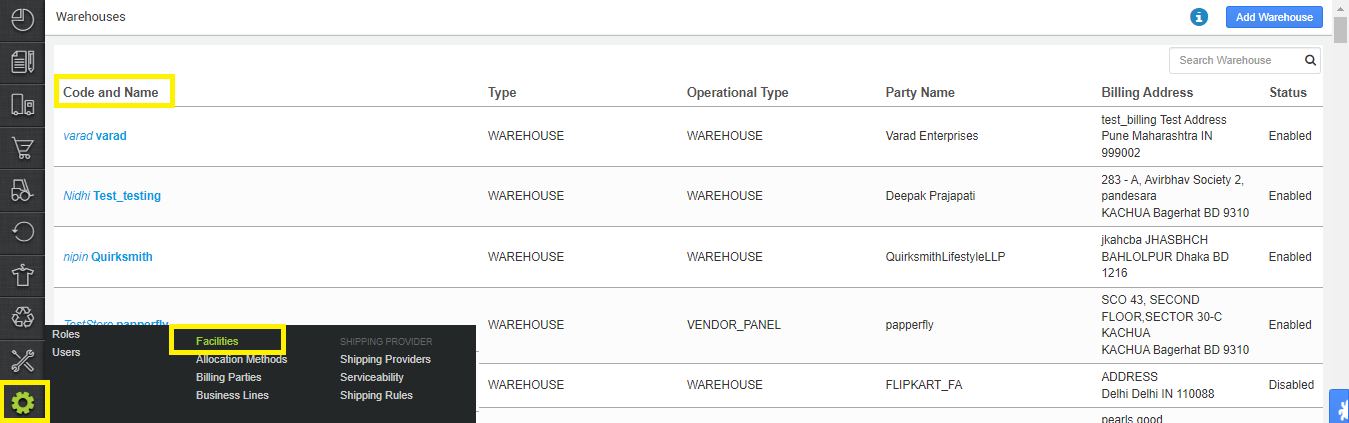

UI Navigation: Settings > Facilities > {Select to open the facility from the list} > Now you can update the Facility details

Enter the details as per the description provided below:

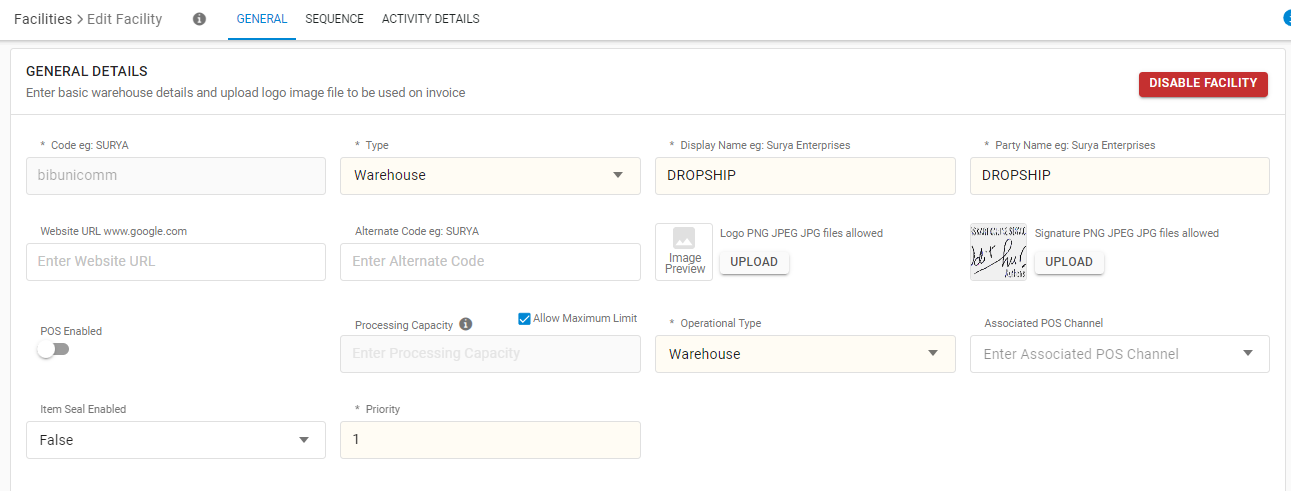

General Details

| Field Name (M: Mandatory) | Values (Default) | Description |

| Code (M) | Alphanumeric Special characters only underscore( _ ) and dash(-) |

|

| Type | Warehouse Dropship Store |

Note: Generally, it is avoided to create a Dropship type facility, as some of the important features are not available for this facility type. |

| Display Name (M) | Alphanumeric |

|

| Party Name (M) | Alphanumeric | Company name for external display like invoice or label print. |

| Website URL | URL | Web address of the seller’s online store |

| Alternate Code | Alphanumeric

Special characters only underscore( _ ) dot( . ) and dash(-) |

For making alternative code. |

| Logo | Image |

|

| Signature | Image |

|

| Processing Capacity | Numeric | Processing Limit is the number of sale order items that can be processed for that particular date

If you marked “Allow maximum limit” then it will skipped the desired number control. |

| Operational Type (M) | Dropdown | Warehouse/Store/Others |

| Associated POS Channel | Dropdown | Associated POS channel with the particular facility |

| Item Seal Enabled | Dropdown | To enable/disable the Tag Loop warehouse operation with seal id. |

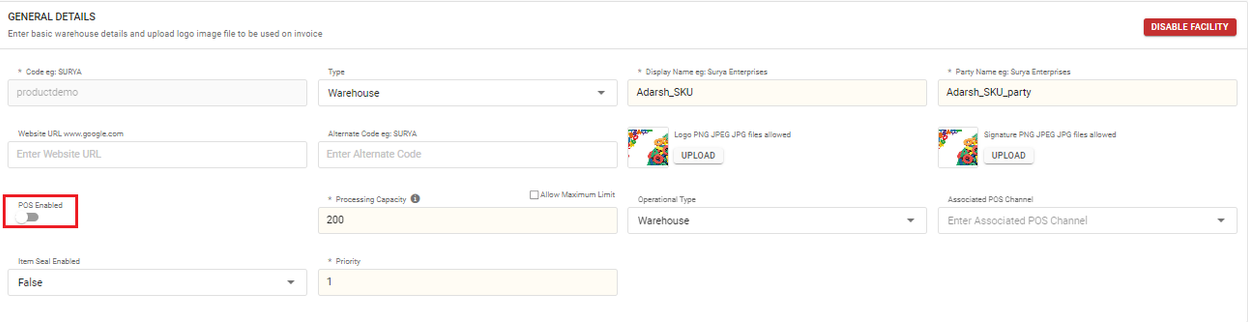

Enable POS for the Facility

Open the facility as specified above, then turn on the POS Enable button.

| Field Name (M: Mandatory) | Values (Default) | Description |

| POS Enabled | ON/OFF (OFF) | ON: To enable point-of-sale channel functionality. Else OFF |

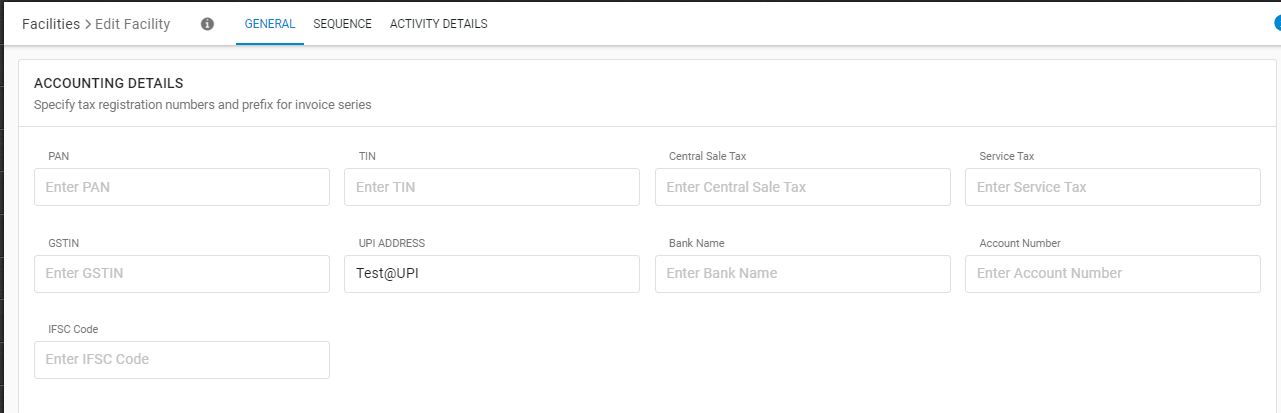

Accounting Details

| Field Name (M: Mandatory) | Description |

| PAN | Company PAN number. |

| TIN | Company TIN number. Not significant after GST implementation. |

| Central Sale Tax | Company CST number. Not significant after GST implementation. |

| Service Tax | Company ST number. |

| GSTIN | Company GSTIN number. Usage: Invoice and other accounting docs |

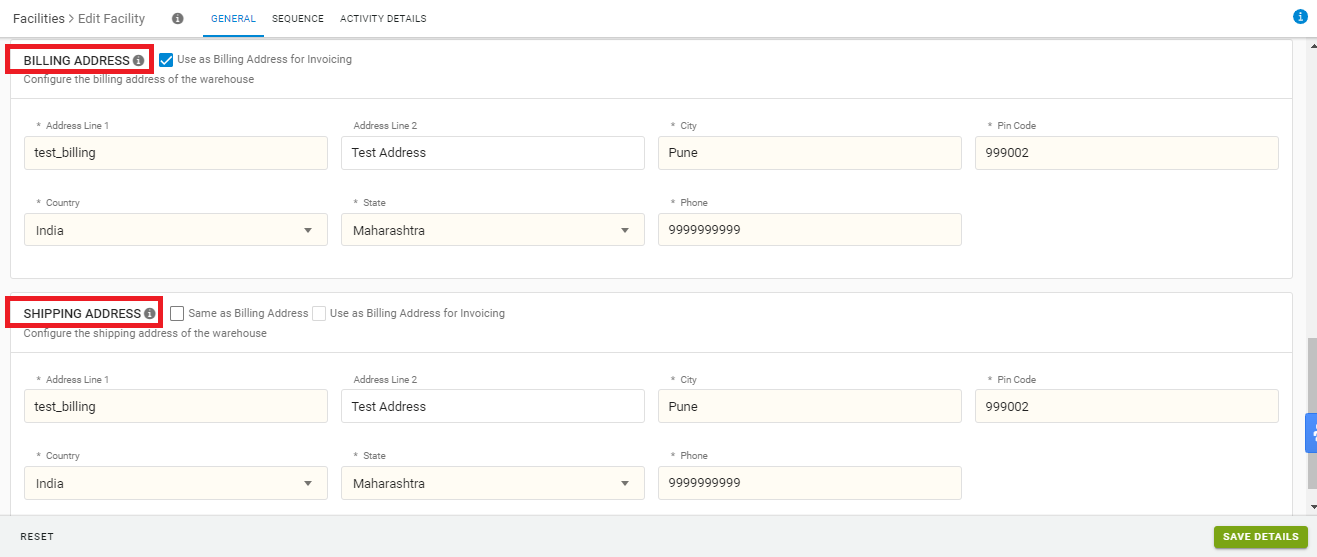

Address

Choose the checkbox at Billing or shipping address as ”Use as Billing Address for Invoicing” for Place of supply consideration for GST Tax Calculation on selected address type. Place of supply consideration for GST Tax Calculation

Billing Address

- It is mandatory to provide billing address details.

- Usage: Invoice and delivering the shipments will be used to determination of an intra-state vs inter-state sale.

| Field Name (M: Mandatory) | Description |

| Address Line 1 (M) | Precise address of billing unit |

| Address Line 2 | Additional address information |

| Country (M) | Country of presence of billing unit (dropdown) |

| State (M) | State name (dropdown) |

| City (M) | City name |

| Pin Code (M) | Pincode |

| Phone (M) | Contact number (Landline or Mobile) |

Shipping Address

- Shipping address can be same as the billing address or different. There is a checkbox to opt.

- Usage: Invoice and delivering the shipments.

Click ‘SAVE DETAILS‘ to create the facility.

Next Step

Now user can also update the Invoice sequence check Set Invoice Sequence

Important Points:

Once the Facility is successfully created, it is recommended to do following settings:

- Set the Traceability Level for each facility.

- If the facility uses ITEM level traceability, then set prefix with parameter ITEM, which is used in item barcode numbering series.

- If applicable, set the following batching configurations to true:

- Batching Enabled (Facility Level): to enable batching for selected facility.

- Batching Enabled (Tenant Level): to enable batching for all facilities.

- Allow Multiple Batch for Single SKU at GRN.

- Set the Selective Facility For Inventory Sync? Select warehouse From dropdown at particular channel page.

- Set facility allocation rule.

- Choose the checkbox at Billing or shipping address as ”Use as Billing Address for Invoicing” for Place of supply consideration for GST Tax Calculation on selected address type. Place of supply consideration for GST Tax Calculation