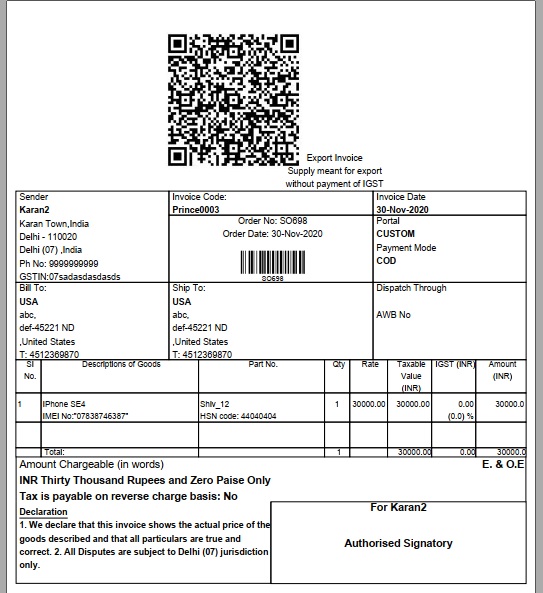

As per Compliance by Indian govt, unicommerce provide the QR code on B2C invoices.

Under this compliance, all the B2C invoices should have a QR code and the customer should be able to scan this QR code and make online payment in case of COD orders. In the case of a prepaid transaction, payment details have to be printed on the invoice. For all orders from Marketplace or Cart.

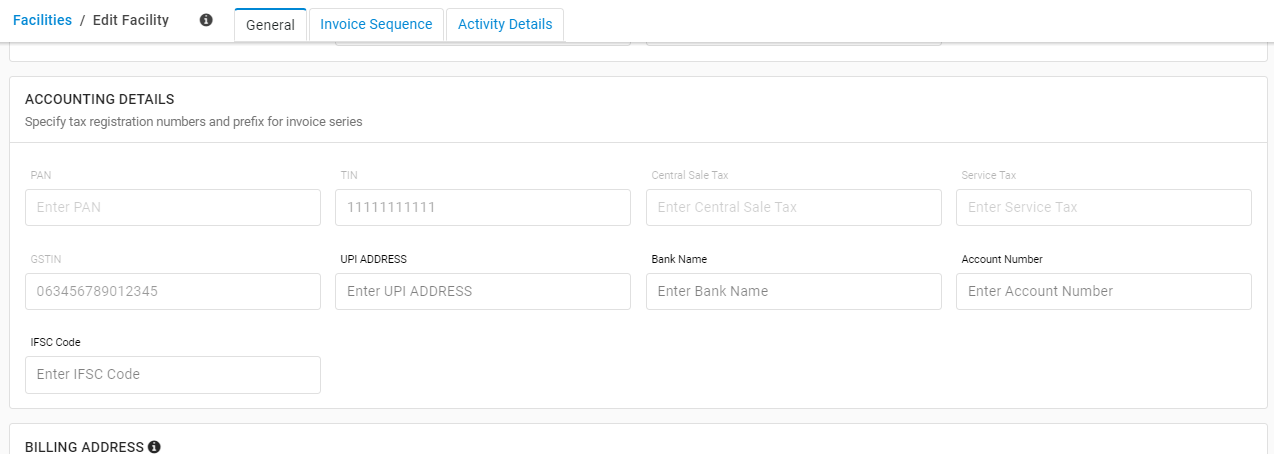

Need to add in Facility and Billing party

Seller needs to mention as per below, Dynamic QR Code is required to contain the following information:

(a) Supplier GSTIN number- Need to add in Facility and Billing party

Note: GSTIN must be exactly 15 digits long as per NIC guidelines.

(b) Supplier UPI ID – Need to add in Facility and Billing party

(c) Payee’s Bank A/C number and IFSC – Need to add in Facility and Billing party

(d) Invoice number & invoice date,

(e) Total Invoice Value and

(f) GST amount along with breakup i.e. CGST, SGST, IGST, CESS, etc.

In case of COD ,

QR Code present on invoice and have the information of

Supplier GSTIN number

Supplier UPI ID

Payee’s Bank A/C number and IFSC

Invoice number & invoice date

Total Invoice Value and

GST amount along with breakup i.e. CGST, SGST, IGST, CESS, etc.

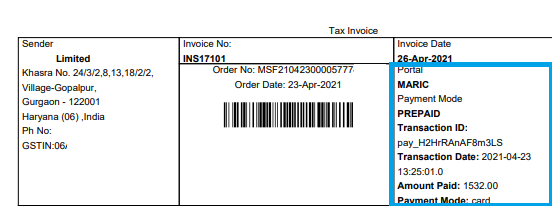

In case of Prepaid,

No QR code on invoice but Invoice has a cross-reference of the payment on the invoice with the following details

- Payment transaction-id

- Payment date and time

- Payment amount

- Payment Mode like UPI, Credit card, Debit card, online banking, etc

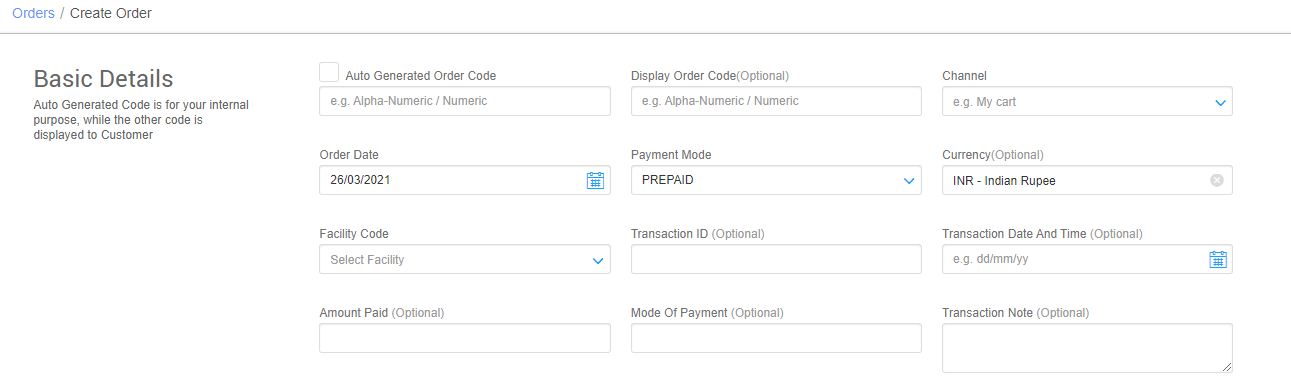

For custom order page value must be filled as per below filed.

Order processing and Invoice generation steps are as same as earlier you do.

To download invoices in Pdf format, you can follow the below steps:

1- Search for a given shipment by selecting ‘Shipment’ on the main menu.

2- Search the required shipment under the respective status Packed (for invoice). Click on the Shipment ID to open its details.

3- On the shipment details page, you can easily reprint invoice in one click.

Note:

- This is required for the sellers whose Turnover is categorized in below mentioned for B2C invoice.

- 13th April 2023:

The GSTN released an advisory on 12th and 13th April 2023 stating that taxpayers with an annual turnover of Rs.100 crore and more must report tax invoices and credit-debit notes to the IRP within 7 days from the date of issue of the invoice/CDN from 1st May 2023. Ref

- 13th April 2023:

- That is tenant-level config and enable our side so raise the case with validity on chat support through uniware account.

- Meet Government compliances of generating QR code in invoice across geographies.

The sellers across different geographies can use configurable QR codes, which can be inbuilt in their customer invoices as per government rules. For more details connect with uniware team Click here. - Note: Important Notification from NIC || HSN Code