An item master is the list of products or items existing within Uniware. It defines the product SKU code (which is unique for each item), its name, the product category it belongs to and the tax associated if any.

In Uniware product or SKU creations, please note:

a) You can use only these four special characters that is

DOT (.)

UNDER SCORE ( _ )

DASH (-)

Slash ( / )

b) Character Limit for creating an SKU is minimum 3 to 45 maximum characters all-inclusive (Numerics, alphabets and four special characters) only.

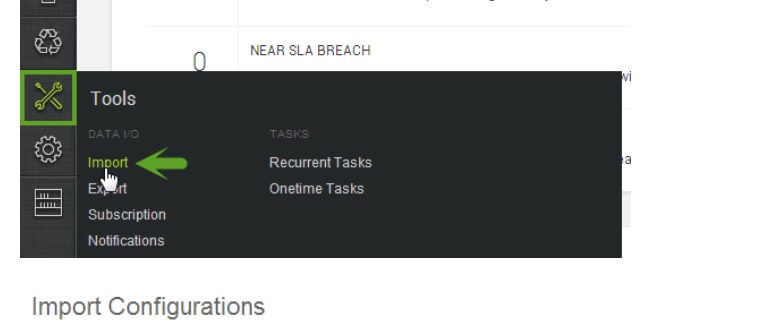

1. To add a new sku in item master, follow the path Tools > Import.

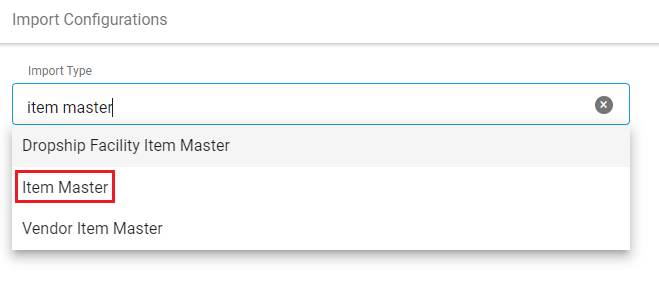

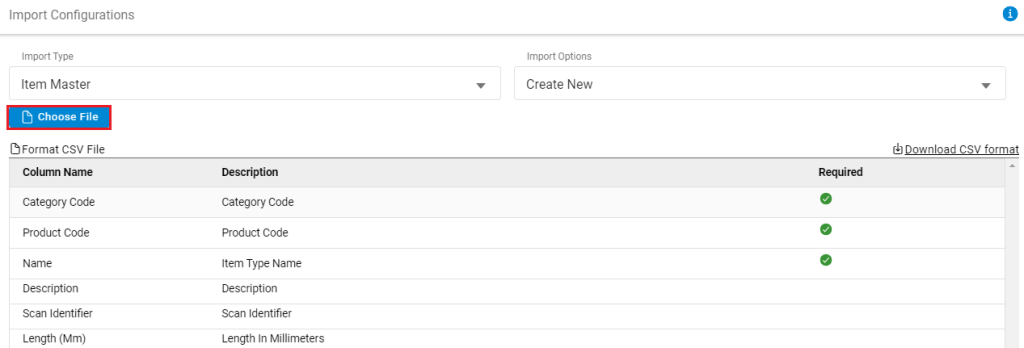

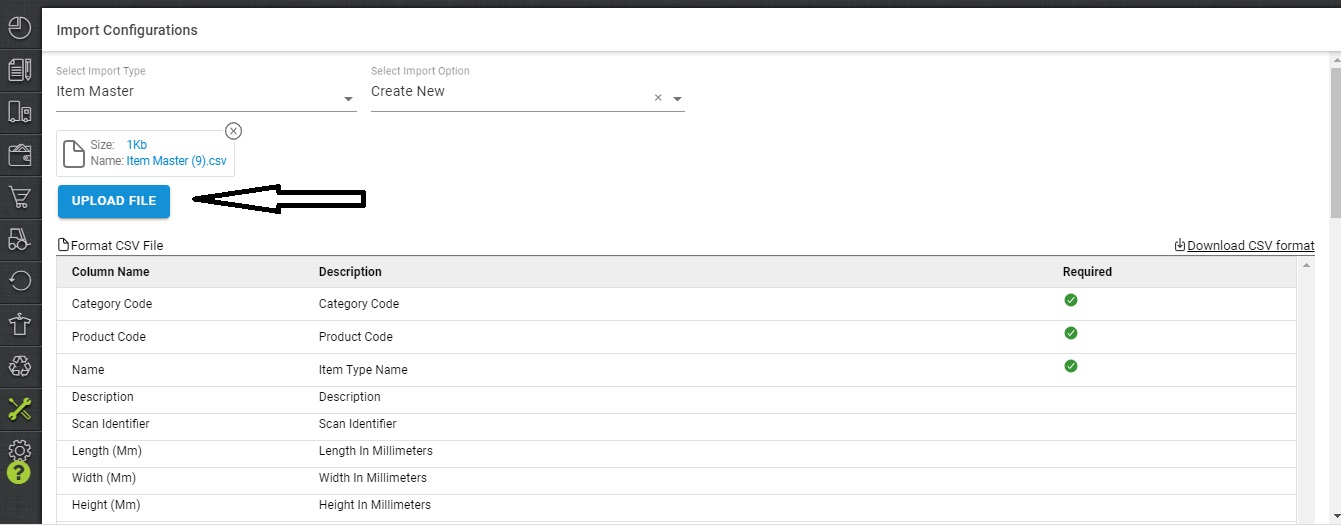

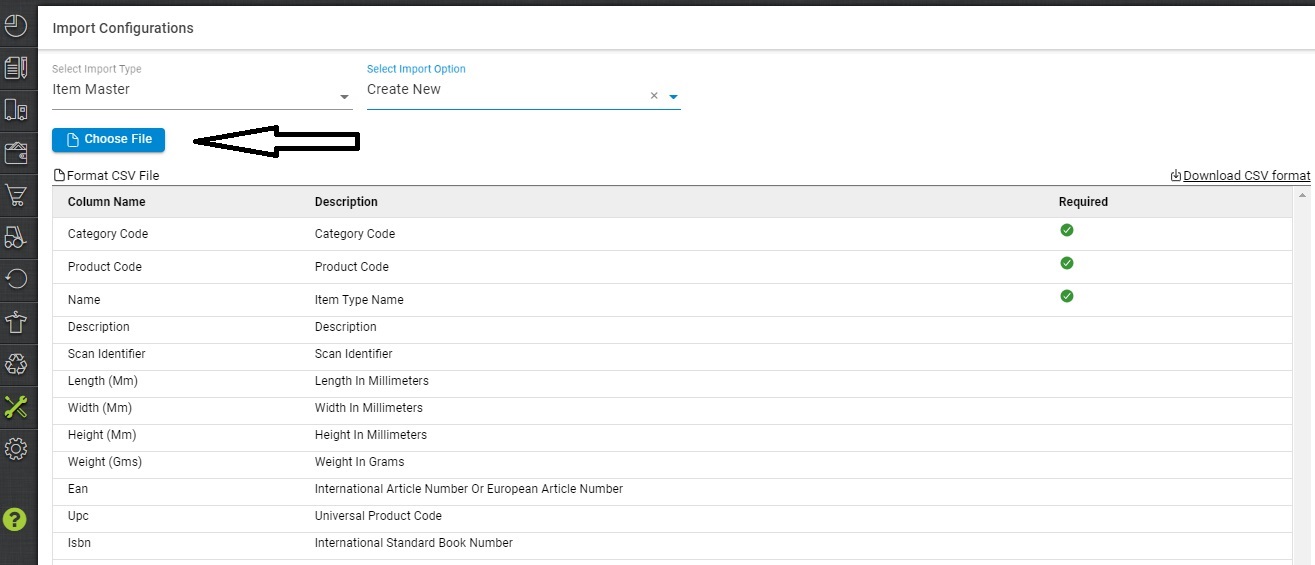

2- Select Item master from the Import Type.

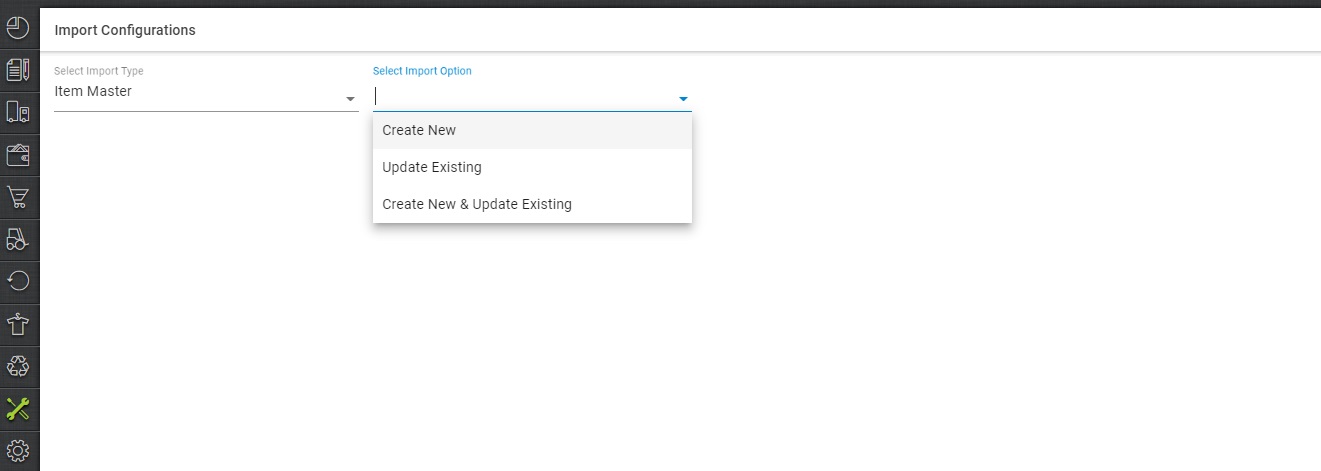

3- To create a new item master (ideally done at setting up of the system), select CREATE_NEW in the Import Options.

3- To create a new item master (ideally done at setting up of the system), select CREATE_NEW in the Import Options.

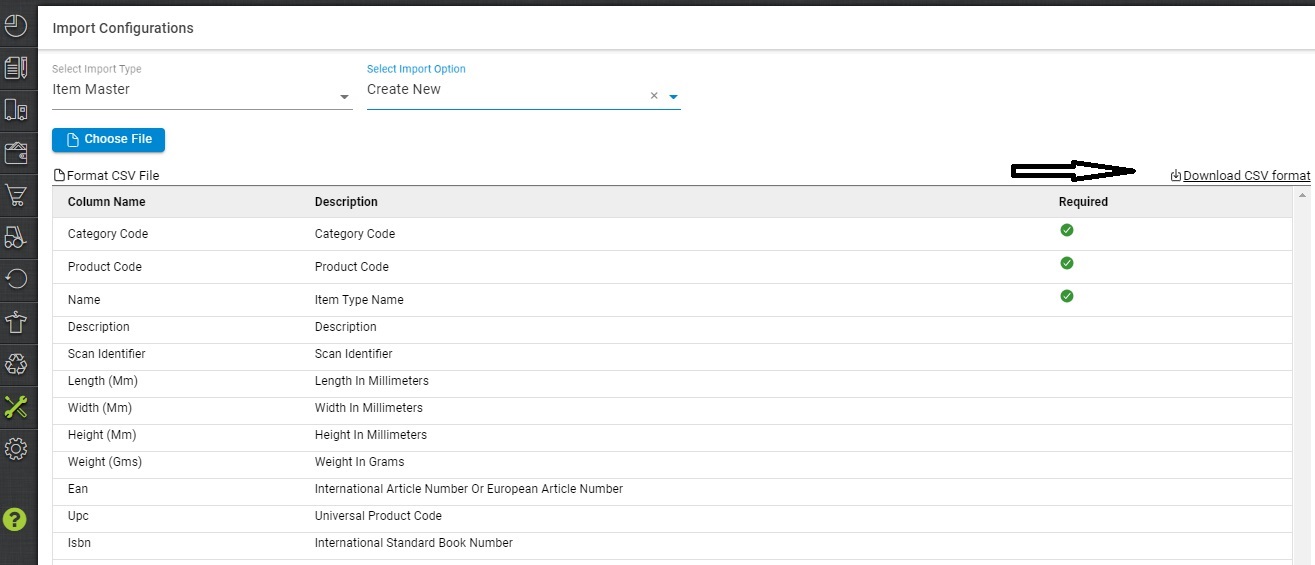

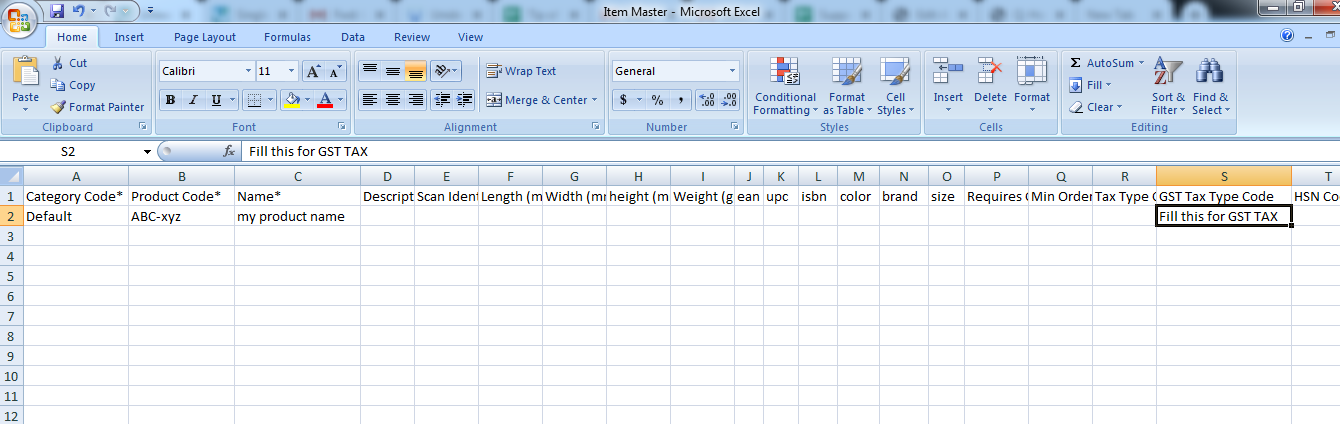

4- Download the csv format and fill the data of your products sku.

5- To update the existing file, just choose the valid option from the Import Options and note that the file needs just the following mandatory fields:

- Category – Fill the category code as per your product category defined in Uniware.

- Product Code – SKU Code As per your choice Product Sku with Uniware sku criteria.

- Product Name – Your product Name as you want to identify it in Uniware.

- GST Tax Type – Select the GST tax type as per your product category tax class, Taxclass/code on UC products should be the same as per defined govt norms. This field is not mandatory yet we recommend to fill to avoid tax calculation issues.

- HSN Code – HSN code is defined by govt norms. Note: Important Notification from NIC || HSN Code

Rest fields you can fill as per your choice for use in system (Optional).

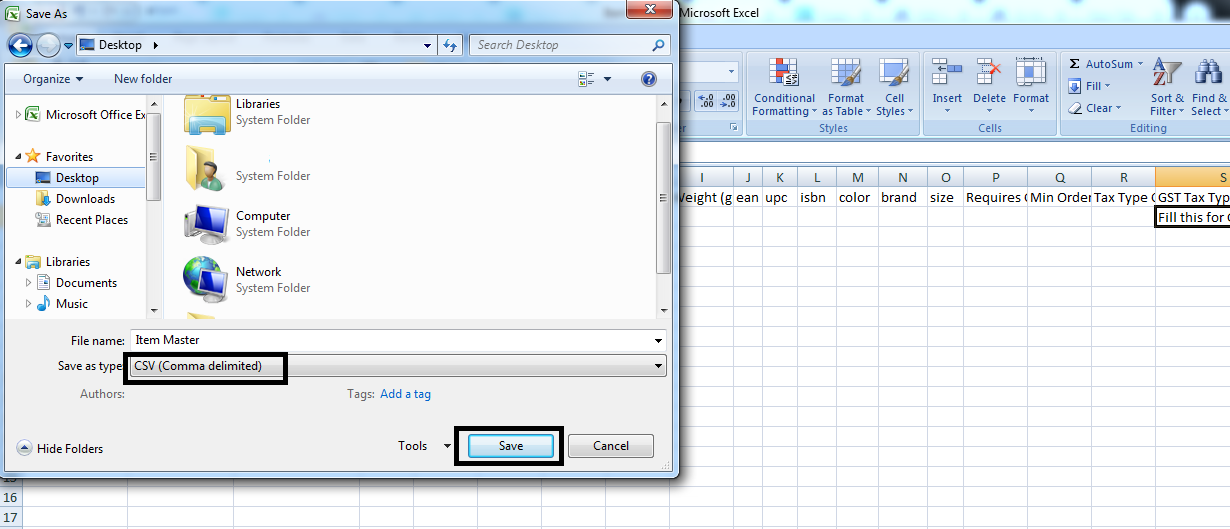

6- Then save the sheet in default format CSV.

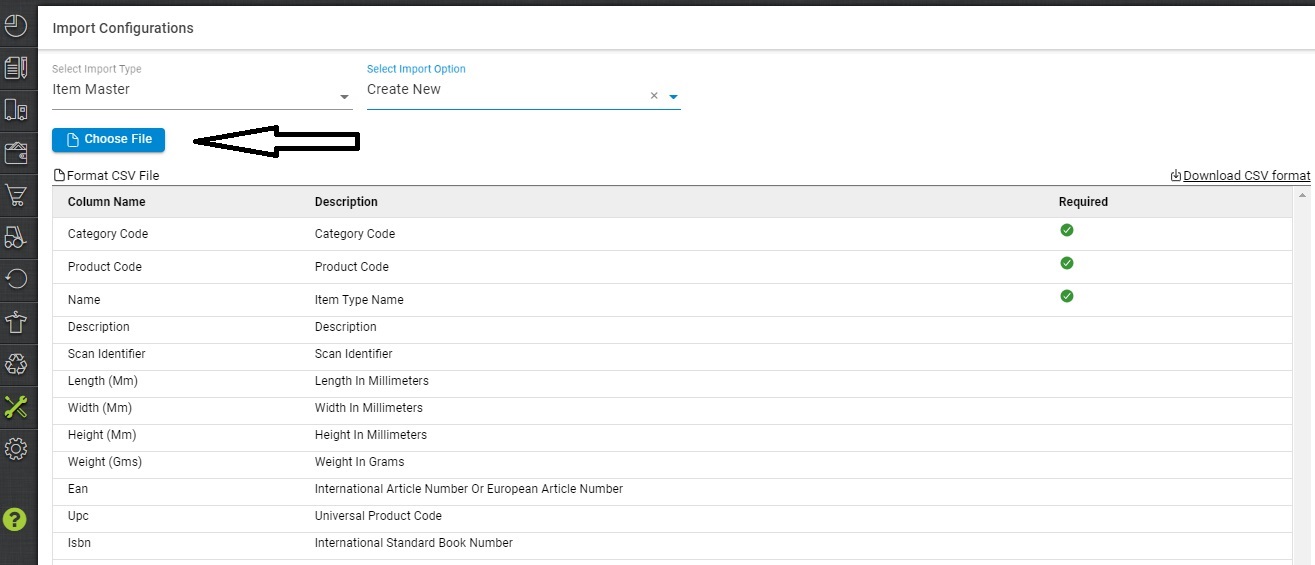

7- Now select the option chose the file and upload the sheet which was filled up as the above steps.

Now press upload button.

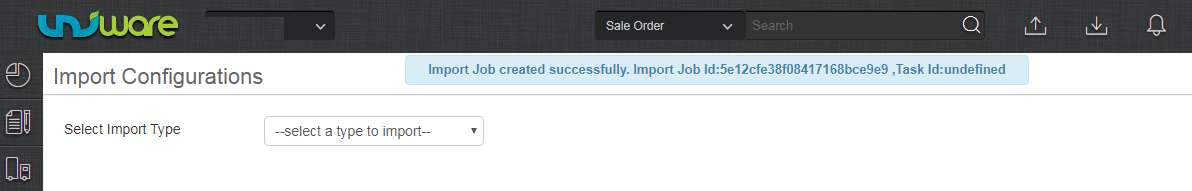

8- Message highlighted for upload.

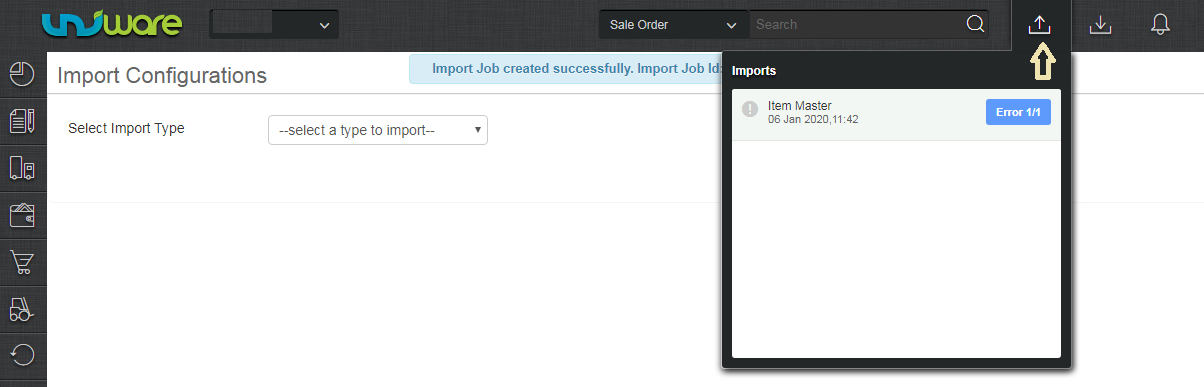

9- You can check the sheet uploaded result with successful uplaod. If there will be any issue in uploaded data you can check the same from View import and repeat the task for sku.

Note:

- Sku code if created can not edit or delete, you can only disable it in uniware.

-

In Uniware, SKU code can be created with a length of 3 to 45 characters and allow only four special symbols as Dash-Dot. Underscore_ and Forward Slash /. However, “Space” is not allowed in Uniware SKU.

- The product weight can be used in grams with decimal points to lead an accurate weight calculation of the shipment.

-

GST Tax Type field is not mandatory yet we recommend to fill to avoid tax calculation issues.

-

Tax class on UC products should be the same as per govt.

- There is a field as SKU Type to filter out the article as Goods(Physical) or service (non-physical) in ItemMaster import/export and Product page. This field helps in E-invoicing

-

The SKU code creation limit for Uniware Standard = 1 Lac and Uniware Professional = 3 Lac

Please note: For Amazon, you have an additional field called “TAT” (Turn Around Time), which can be updated against each item created in the list.

How Do We Update The Item Master?

To Update Item Master, follow the below steps:

1- Go To Tools> Imports> Item Master> Create New and Update existing> Download CSV Format

2- Fill the downloaded CSV file with the details of the columns which need to be updated, along with all the Mandatory Columns and the details which were already updated for that product in Uniware.

Note: Rest of the already updated details of the product get blank if you upload the sheet with details in the column which need to be updated and the Mandatory Column details.

For example: If you need to change the GST Tax Type code of your products, you need to Go to Tools> Import> Item Master> Create new and update existing and fill downloaded CSV with below details:

-

All Mandatory column in the sheet (the ones with asterisk)

-

GST tax type code column with updated details.

-

HSN CODES (if while importing the sheet this column is missed, then HSN field will go blank for all the SKUs imported via item master)

FAQ:

Q: How do we enable/disable a product?

Recommended for you:

Key Metrics to Track in the KPI Dashboard & E-commerce Reports

Ref: I: 1089241091 X: 1473445959