At the onset of each new fiscal year, sellers aim to revise the invoice series or sequence without disrupting the existing one. To achieve this, they can use this process flow.

As the new financial year (2024-25) is approaching, we are ready to provide a smooth transition to all the sellers to update/reset the invoice and other sequences.

Important points:

- This procedure will work for all custom orders and channels where uniware provides its own invoice series as per your facility or billing party setting.

- The changes listed below are for both Facilities (warehouses) and Billing Parties.

- You don’t need to worry about the channels from which UC fetches the invoice series from channel end, such as Flipkart, Amazon, Snapdeal, Nykaa etc.

- According to the GST Invoice format and rules shared by the Indian Government gst-invoice-format-rules, all invoice prefixes can contain alphabets or numerals or special characters hyphen (dash) and slash symbolized as “–” and “/” respectively, and any combination thereof. All other special characters are not allowed.

- You can refer to the detailed doc to do the same in bulk from import way. Ref: Sequence Detail Import | Import

Keep in mind

We have a field “Next Year Prefix“, Actions taken in this field will make below changes in the existing invoice series at the onset of fiscal year.

- We suggest you update the current or the new prefix e.g. /24-25/ at field “Next Year Prefix”. This will help you differentiate the current financial invoice from the next financial year invoice series.

- Before filling the values, we recommend to take export file as “Sequence Detail” from Uniware. Then try to update via UI or import only with one row first. If all looks fine then only you can proceed for the bulk action.

- Don’t leave any important sequence field “Next Year Prefix” blank , specifically for Sales Invoice{SALE_INVOICE} and Sale Return Invoice {SALE_RETURN_INVOICE}.

- Values filled in ‘Current Value’ can not be decremented once update by seller.

Applicability

Version : All versions (Standard/Professional/Enterprise)

Traceability : None, SKU, ITEM

General Setting Configuration : Date Of Prefix And Counter Update On Next Year(Tenant Level) – fill the start date of financial year as per region/country financial year specified by govt. E.g. For India, it is 1st of April (Default) (Every year)

Procedure

You can choose the case as per your business and finance setup:

| Cases | Prefix | Sequence (Current Value) |

Next Year Prefix | Reset Counter Next Year |

| Case 1 | Continue with Current year | Continue with Current year | Fill the same as Current year prefix | False |

| Case 2 | Continue with Current year | Rest/New | Fill the same as Current year prefix | True |

| Case 3 | Rest/New | Continue with Current year | Fill a new Prefix | False |

| Case 4 | Rest/New | Rest/New | Fill a new Prefix | True |

Note: By default, the Reset Counter task will executed midnight 1st April, which means your Invoice Sequence will be updated from midnight 1st April. So need to mark it False by the below steps:

Please follow the way listed below for both Facilities (warehouses) and Billing Parties

- A: Invoice Sequence update at Facility:

- B: Invoice Sequence update at Billing Parties:

A: Invoice Sequence update at Facility:

For Sequence update at facility , please follow the below steps:

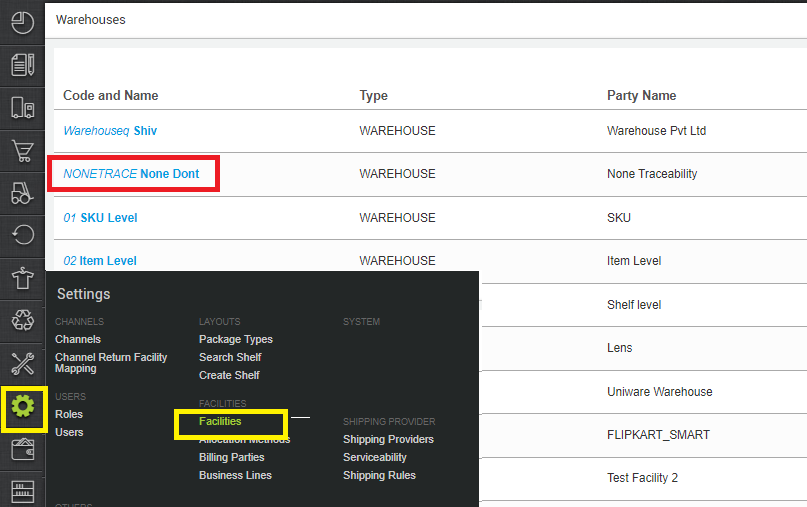

UI Navigation: Settings > Facilities > {click on the desired facility} > Sequence

A.1- Go to Facilities under Settings,{click on the desired facility}

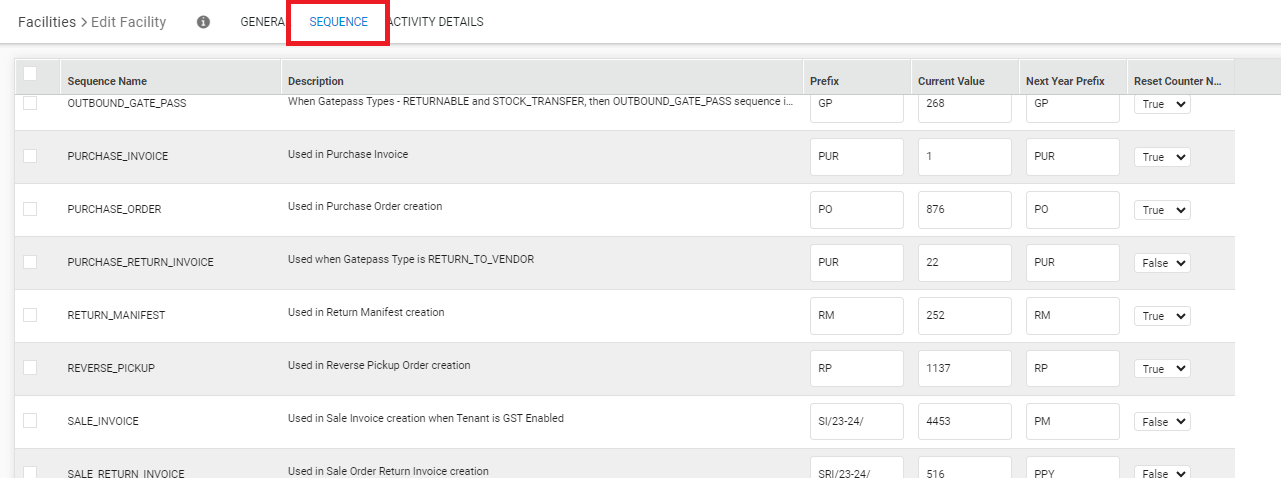

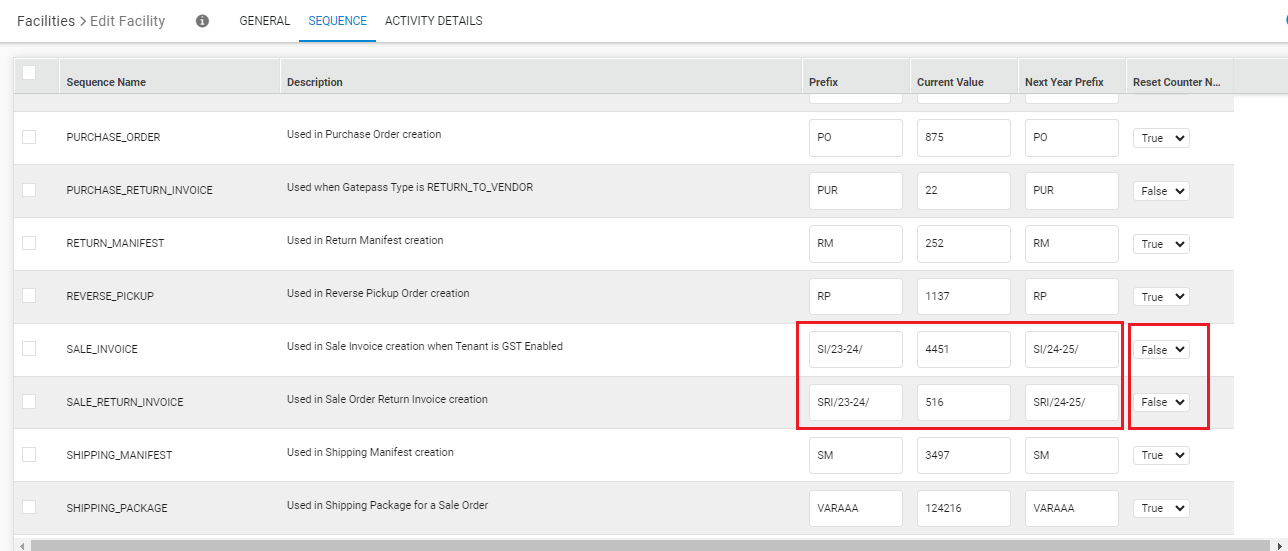

A.2- Open the Sequence widget

- You can choose the case as mentioned above as per your business and finance setup.

- Here you can update the Reset Counter Next Year and Next Year Prefix for the desired sequence. e.g. Sales Invoice and Sales Return Invoice.

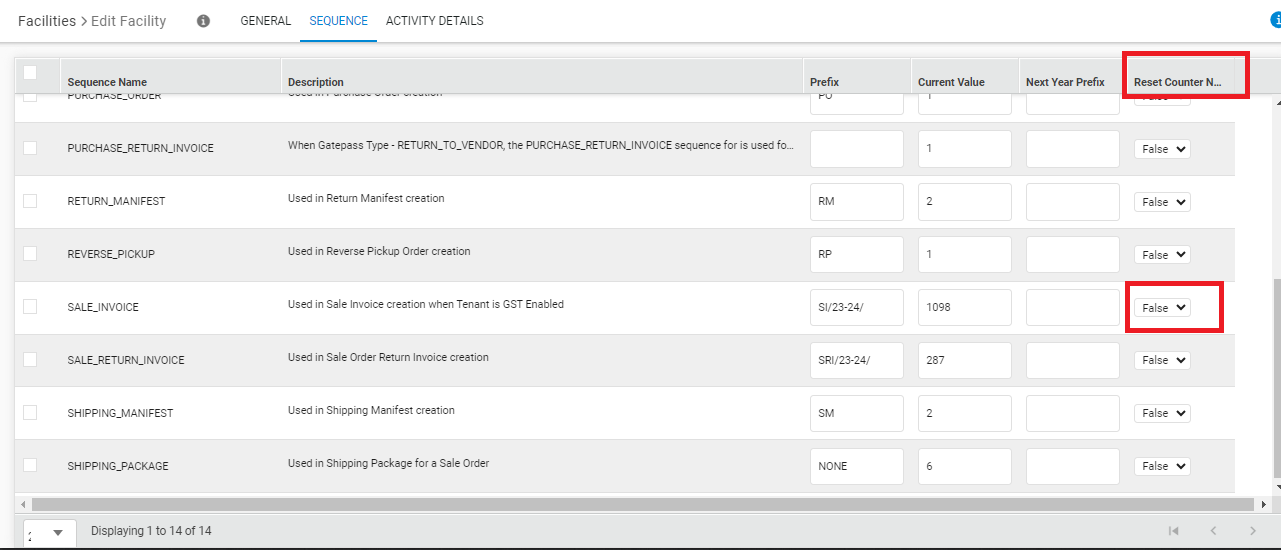

A.Case1

To continue with the current year invoice Prefix with the same old invoice sequence.

Sequence update at Facility:

- Next year Prefix = fill the same as current year prefix

- Reset Counter Next Year = False {which means your selected Sequence will be continued with current value}

A.Case2

To continue with the current year invoice Prefix but reset invoice sequence.

Sequence update at Facility:

- Next year Prefix = Fill the same as current year prefix

- Reset Counter Next Year = True {which means your selected Sequence will be continued from reset value (1)}

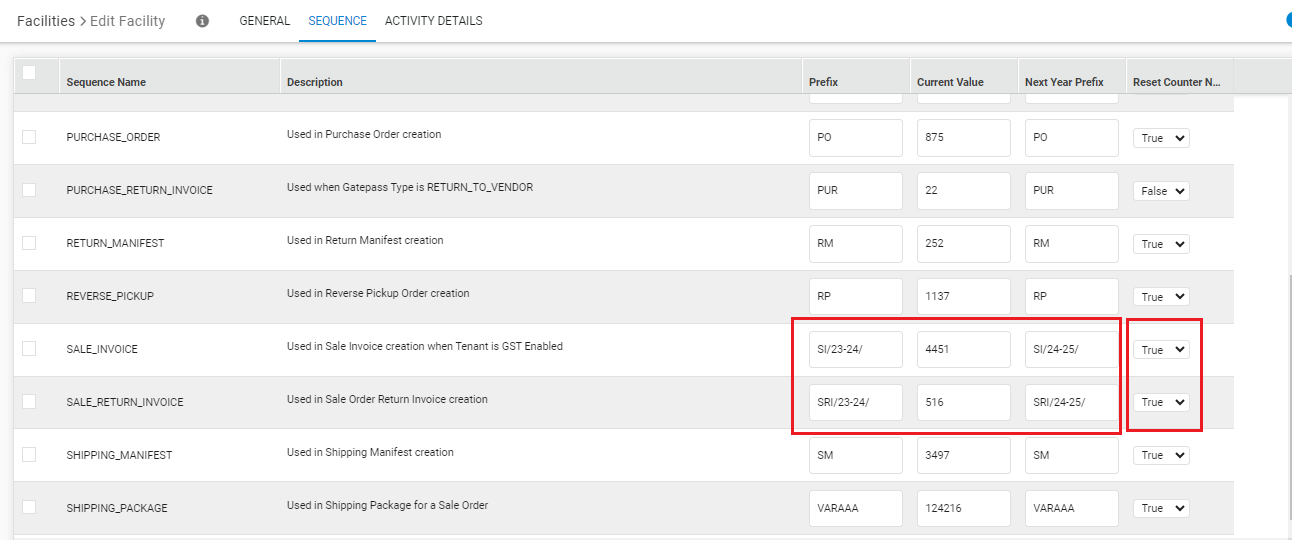

A.Case3

To continue with the new year invoice Prefix with old invoice sequence.

Sequence update at Facility:

- Next year Prefix = Fill the new current year prefix

- Reset Counter Next Year = False {which means your selected Sequence will be continued with current value}

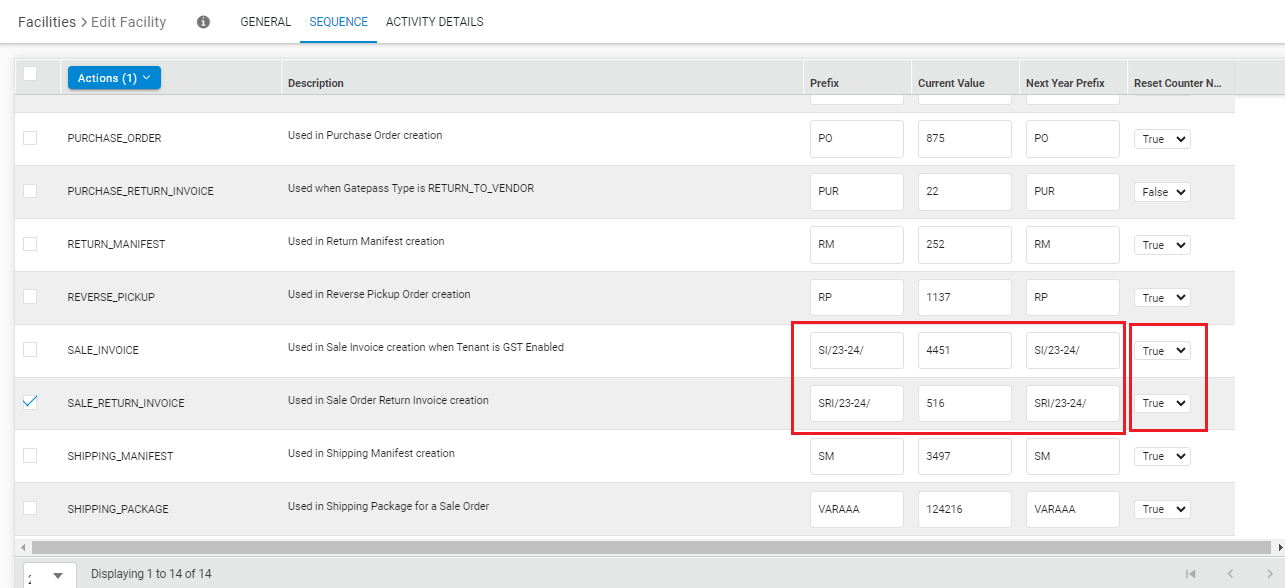

A.Case4

To continue with the New year invoice Prefix with reset sequence

Sequence update at Facility:

- Next year Prefix =Fill the new current year prefix

- Reset Counter Next Year = True {which means your selected Sequence will be continued from reset value 1}

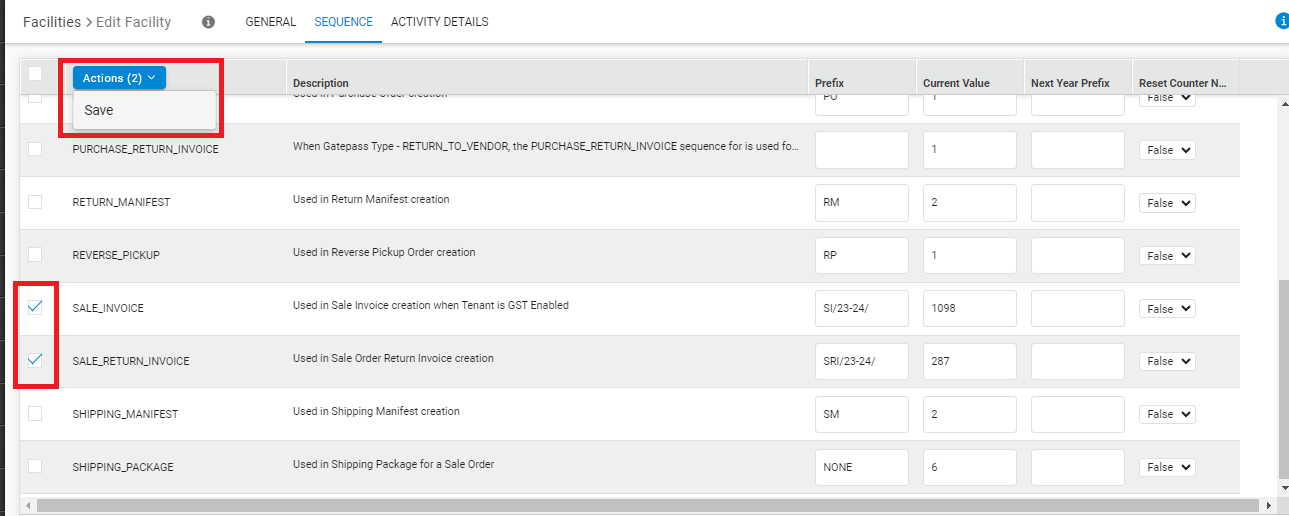

Now you can select the updated rows and Save it post verifying the changes.

A.3- Select the sequence rows > Action > Save

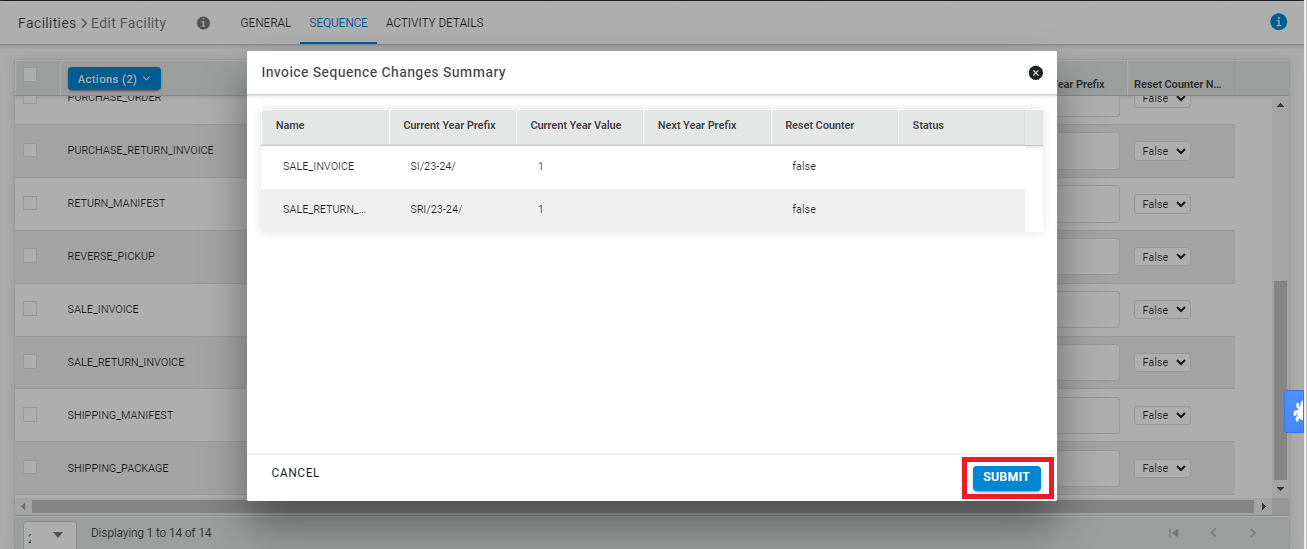

A.4- Here you can reverify the changes and then press Submit to save the changes.

Similarly you can make the changes for Billing Parties. (Click here to know more)

B: Invoice Sequence update at Billing Parties:

For Sequence update at facility, please follow the below steps:

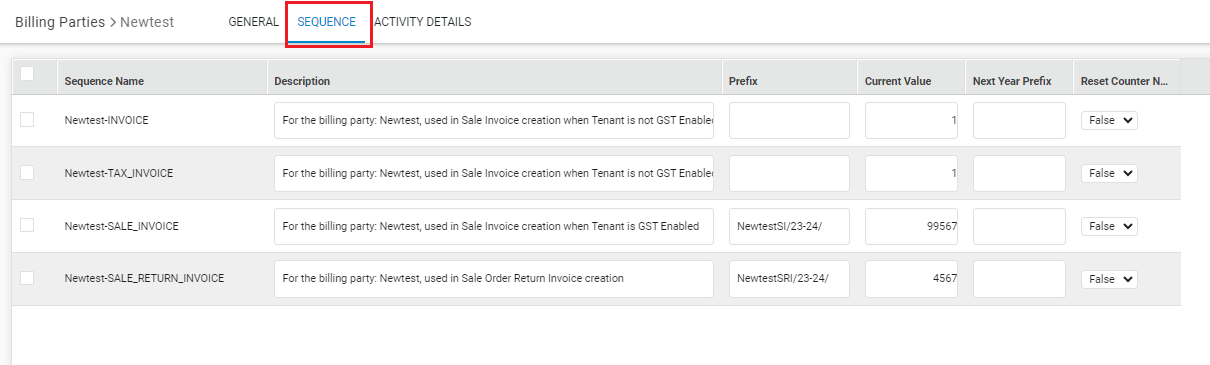

UI Navigation: Settings > Billing Parties > {click on the desired billing party} > Sequence

B.1- Go to Billing Parties

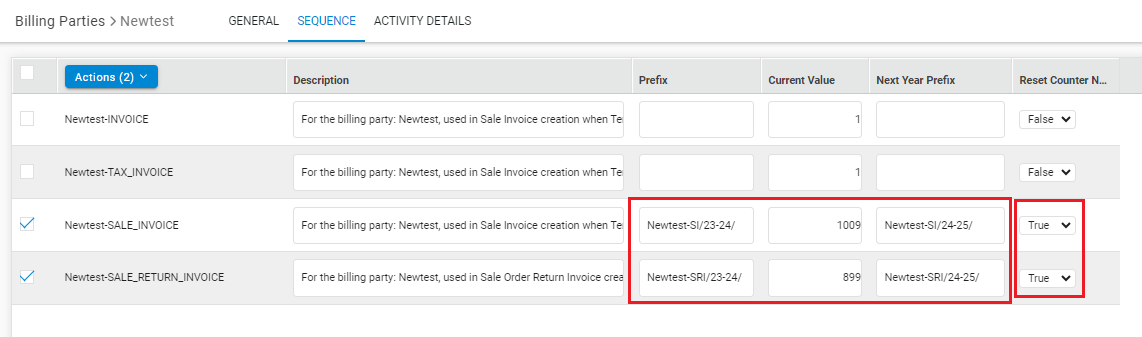

B.2- Open the Sequence widget

- You can choose the case as mentioned above as per your business and finance setup.

- Here you can update the Reset Counter Next Year and Next Year Prefix for the desired sequence. e.g. Sales Invoice and Sales Return Invoice.

B.Case1

To continue with the current year invoice Prefix with the same old invoice sequence.

Sequence update at Billing Parties:

- Next year Prefix = fill the same as current year prefix

- Reset Counter Next Year = False {which means your selected Sequence will be continued with current value}

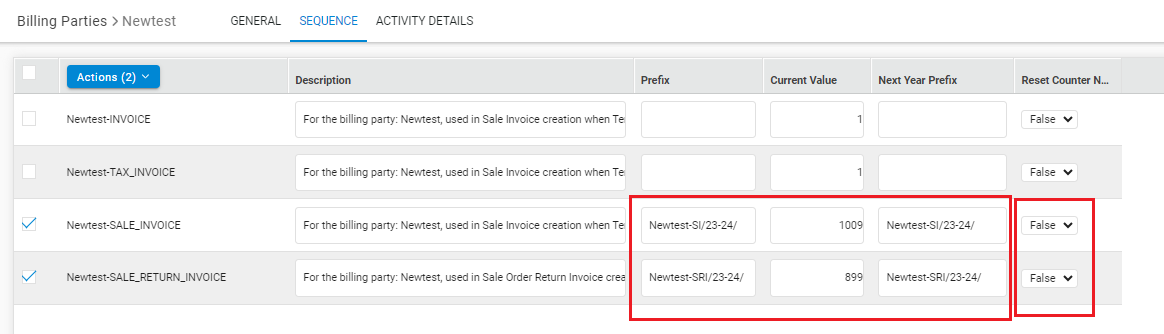

B.Case2

To continue with the current year invoice Prefix but reset invoice sequence.

Sequence update at Billing Parties:

- Next year Prefix = Fill the same as current year prefix

- Reset Counter Next Year = True {which means your selected Sequence will be reset to 1 and be continued from reset value (1)}

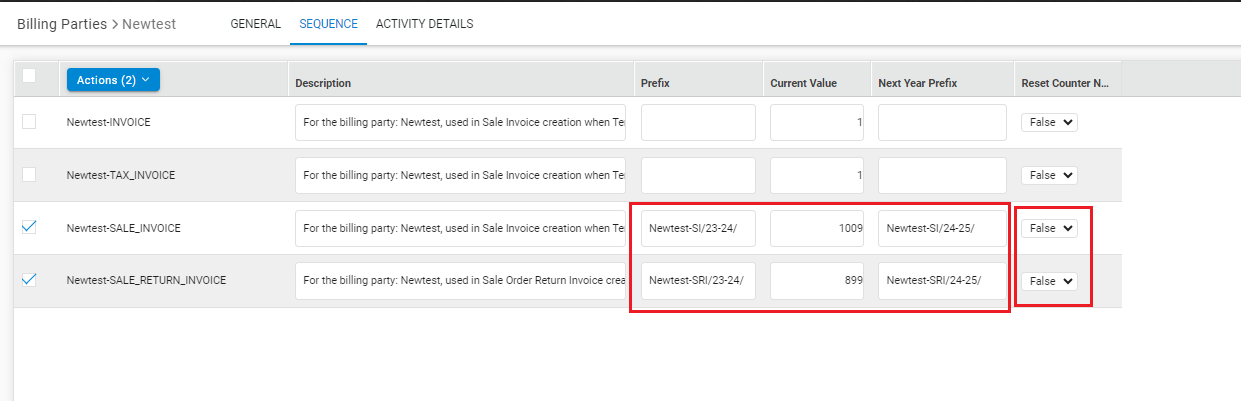

B.Case3

To continue with the new year invoice Prefix with old invoice sequence.

Sequence update at Billing Parties:

- Next year Prefix = Fill the new current year prefix

- Reset Counter Next Year = False {which means your selected Sequence will be continued with current value}

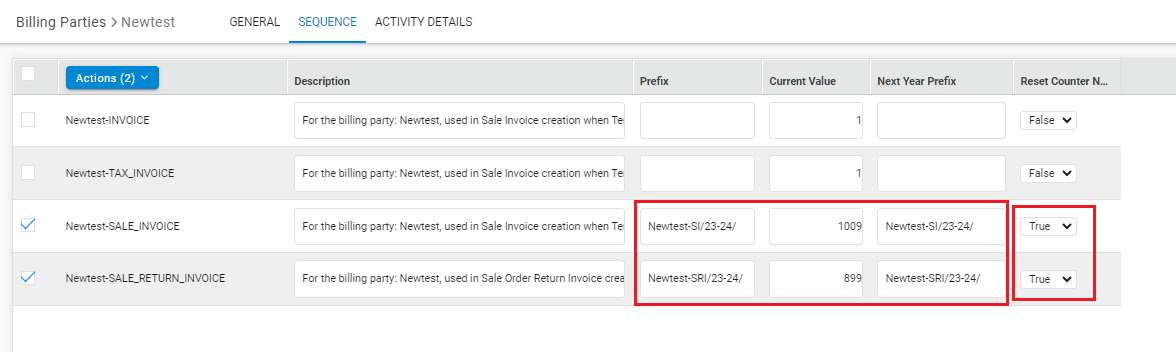

B.Case4

To continue with the New year invoice Prefix with reset sequence

Sequence update at Billing Parties:

- Next year Prefix =Fill the new current year prefix

- Reset Counter Next Year = True {which means your selected Sequence will be reset to 1 and will be continued from reset value 1}

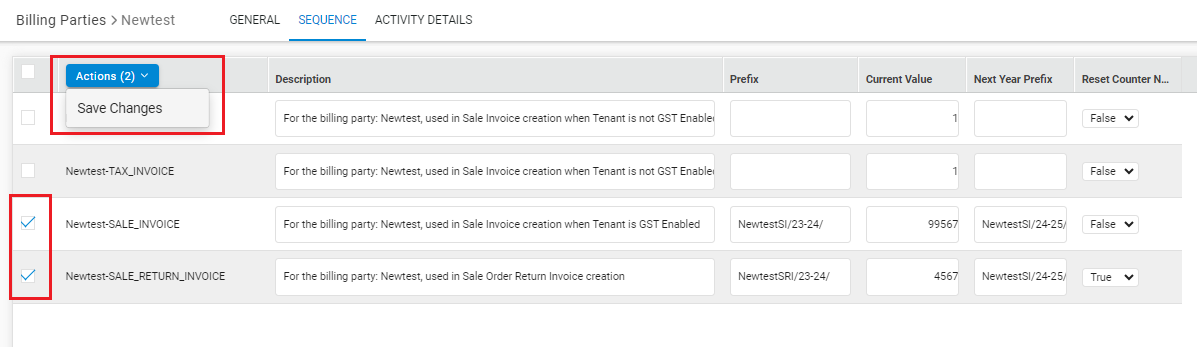

Now you can select the updated rows and Save it post verifying the changes.

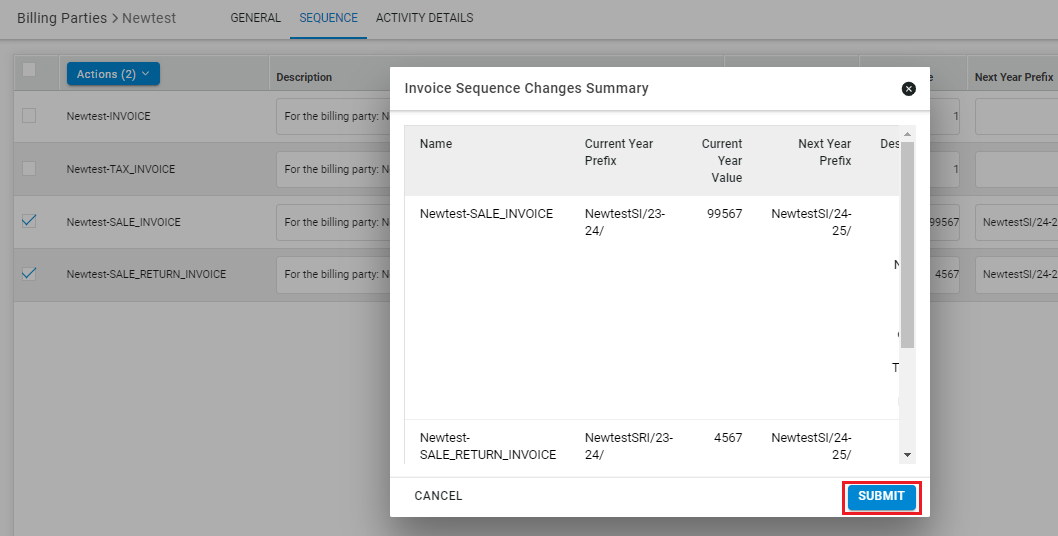

B.3- Select the sequence rows > Action > Save

B.4- Here you can reverify the changes and then press Submit to save the changes.

We request you to please update these fields and ensure a smooth business run in the coming financial year.

For any concerns in this, please raise a ticket with Uniware Support.