Tax collected at Source on sale of Goods effective from 01st October 2020

With a view to widening the tax-net, the Indian government (vide the Finance Act, 2020) has extended the scope of Tax Collected at Source (“TCS”) provided under Section 206C of the Income-tax Act, 1961. As per the extended scope, tax is required to be collected at the source on sale of goods by a specified seller (exceeding a specified limit). Such extended scope is applicable from 1 October 2020.

Uniware handles this feature and for this, you need to raise the case on chat support through uniware account.

In uniware,

- TCS visibility in Invoice, Tally report, Sale order report.

- Invoice Print and Invoice Tab of Shipment.

- Dashboard > Invoices tab >Amount Details column

This can be handled channel-wise or bulk customer wise.

Applicability

Configuration:

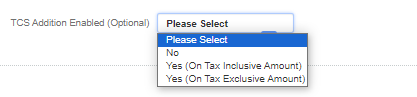

“TCS Addition Enabled” This configuration offers three options:

- No (Default)\

- Yes (On Tax Inclusive Amount)

- Yes (On Tax Exclusive Amount)

Visibility:

You can find the TCS Addition Enabled configuration on:-

- Customer details page

- Channel configuration page

- Vendor configuration page

Can we fetch TCS from channels in general & store it in our system?

No, Regarding fetching TCS from channels and storing it in the system, it’s currently not feasible to fetch TCS from MP.

FAQ:

Who is liable to collect TCS?

The seller is liable to collect TCS if their total sales, gross receipt, or turnover exceeds Rs.10 crores during the financial year immediately preceding the one in which the sale is conducted. This implies that the total turnover of FY 2019-20 should exceed INR. 10 crores.

From whom TCS is to be collected ?

TCS is to be collected from the buyer whose aggregate purchases from the seller exceed Rs.50 lacs in the previous year.

On which amount TCS has to be collected?

TCS is required to be collected only on the sale consideration exceeding INR. 50 lacs. In other words, TCS is not applicable to the first INR. 50 lacs of sale consideration.

What is rate of tax for TCS?

The rate of TCS specified in the section is 0.1% of the sale consideration. However, according to a Press Release dated 13.05.2020, the rate of tax for the current financial year has been reduced to 0.075%.

Note: This provision is applicable to both B2B and B2C transactions.