As per compliance by the Indian govt, unicommerce provides the E-Invoice Feature for all B2B order invoices.

SOP:

As per compliance by the Indian Government., Unicommerce provides the E- Invoice Feature for all B2B order invoices. To enable the same, clients need to register themselves on the Government NIC Portal with all required information, it can be done by following the NIC – GSP set up document.

A. Post-registration on NIC portal, seller has to share the information with Unicommerce team in the format attached and with the help of shared data, UC team will further activate the E-Invoicing in Uniware.

-

- In the shared format, we’ll required two type of information:

-

Company Related Information: as shown in the table below:

-

NIC Related Information: as shown in the table below:

Note: Post-registration on NIC portal E-Invoice NIC – GSP set up document seller has to share his API username and password with us to configure through uniware support chat. Ref: SOP

B. After receiving the data in the above shared formats, KAM will share it with the Logitax team (support@logitax.in) keeping their managers in loop for further mapping and generating global URL, Client Code, User Code and Password.

Please check and upload gsp_provider_name as LOGIBRICKS for einvocie govt portal at form filling. However on govt portal you need to select “Vay Network Services Pvt Ltd“.

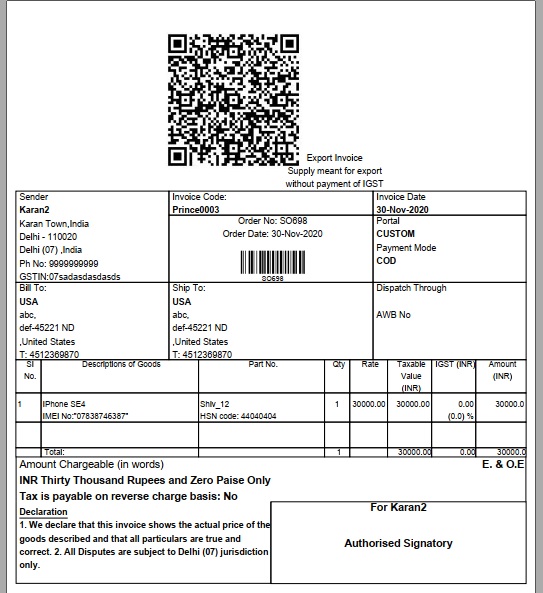

QR Code have the information of

GST Number

Invoice Number

Invoice Creation Date

Items Qty

HSN Code

Invoice Total

Note: Order processing and Invoice generation steps are as same as earlier you do.

To download invoices in Pdf format, you can follow the below steps:

1- Search for a given shipment by selecting ‘Shipment’ on the main menu.

2- Search the required shipment under the respective status Packed (for invoice). Click on the Shipment ID to open its details.

3- On the shipment details page, you can easily reprint invoice with one click.

Note:

- This is required for the sellers, with a Turnover is 10 crores yearly for B2B invoices as per new update of govt.

- 24th February 2022: The e-Invoicing system will get extended to those annual aggregate turnover of more than Rs.20 crore starting from 1st April 2022, vide notification no. 1/2022. Earlier it was Rs.50 crore.

- 1st August 2022: The e-Invoicing system for B2B transactions has now been extended to those with an annual aggregate turnover of more than Rs.10 crore starting from 1st October 2022, vide notification no. 17/2022.

- 1st August 2023: Recently, govt has extended the e-invoicing for businesses having more than Rs 5 crore turnover w.e.f 1st August 2023. Ref: FAQ

- As per Indian government norms, E-Invoice for B2B transaction is applicable for the supply of goods(Physical) or services(non-physical) or both to a registered person/entity.In Uniware we are able to create E-Invoices for of goods(Physical) or services(non-physical) Articles.To handle this, in UC we have a field to filter out the article as goods(Physical) or services(non-physical) in ItemMaster import/export and product page UI.

-

Sellers can now generate e-invoice for international orders in foreign currency.

- For GstEInvoice generation, check the GSTIN must be available on Customer/ToParty added in channel, Where customer adding on channel is applicable.

Note: Customer GSTIN must be exactly 15 digits long as per NIC guidelines. - While generating the invoice in uniware, all B2B invoices hit to Govt portal with multiple details and IRN (Invoice Reference Number) hit back to uniware in form of QR code on Invoice Pdf irrespective of payment method.

- QR Code have the information of GST Number, Invoice Number, Invoice Creation Date, Items Qty, HSN Code, and Invoice Total.

- Users can add charges like shipping charges, gift wrap charges, COD Charges etc to the invoice while E-invoicing.

- Einvoice cancellation- such invoice can not be cancelled after 24 hours of generation.

- That is facility-level config and enable our side to “Forward Gst EInvoice Enabled” and “Gst EInvoice Enabled for Tenant” so raise the case with validity on chat support through uniware account.

- Post-registration on NIC portal seller has to share his API username and password with us to configure. Ref: NIC– GSP set up doc

- Note: Important Notification from NIC || HSN Code