Please follow the below steps to add VAT Tax in Uniware:

1. On the path go to Products > Tax Classes:

2. follow the Further Instructions provided below

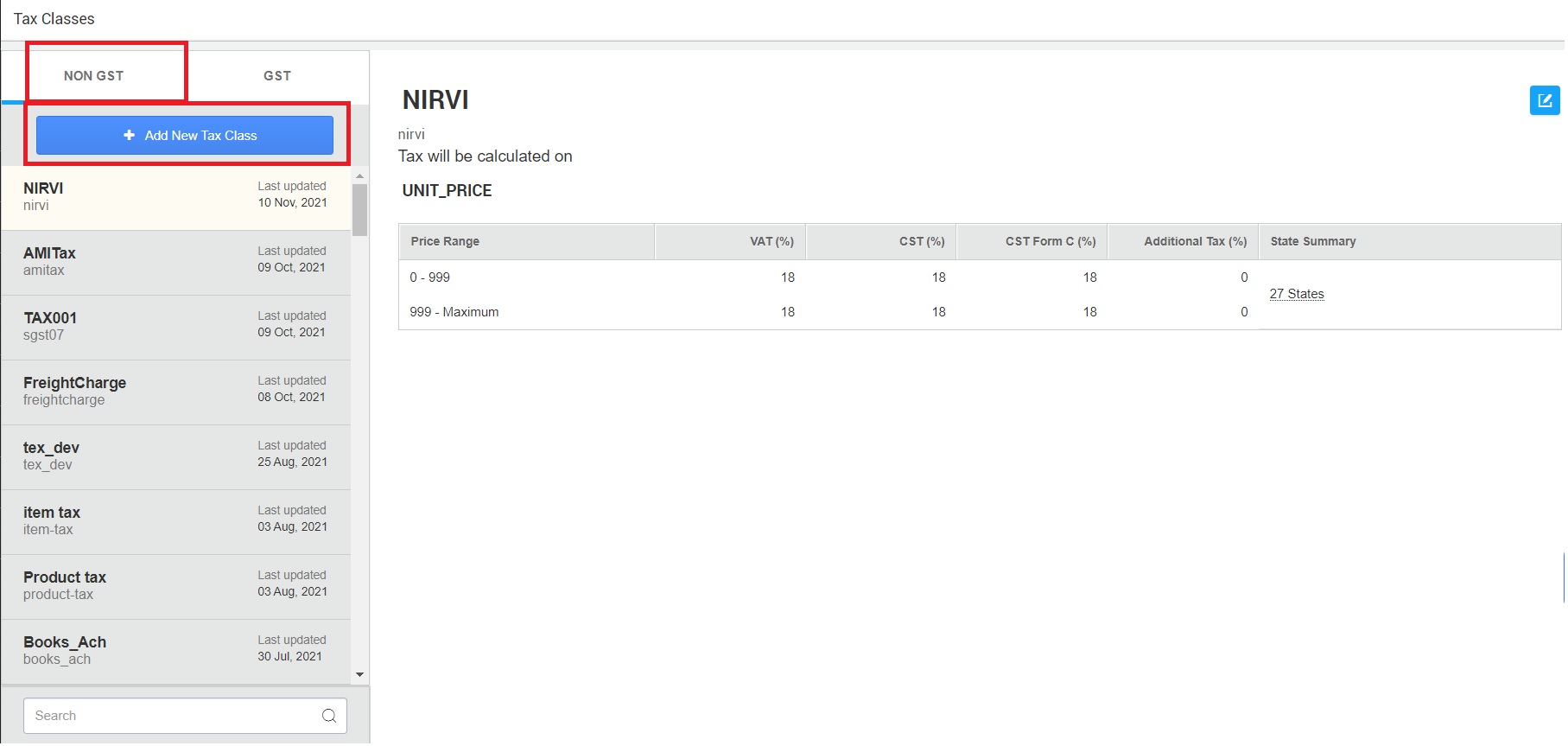

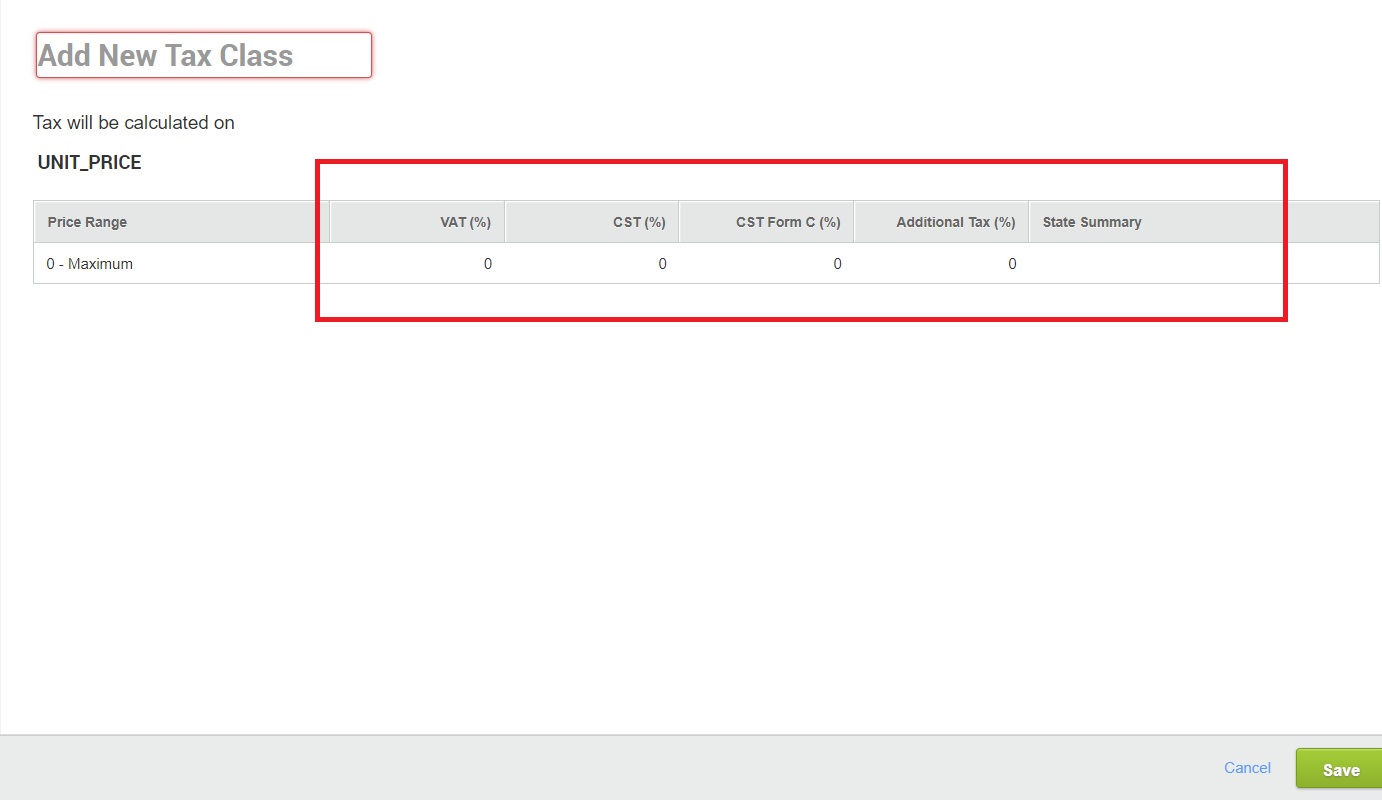

a- Click on NON- GST tab

b- Click on Add new Tax Class.

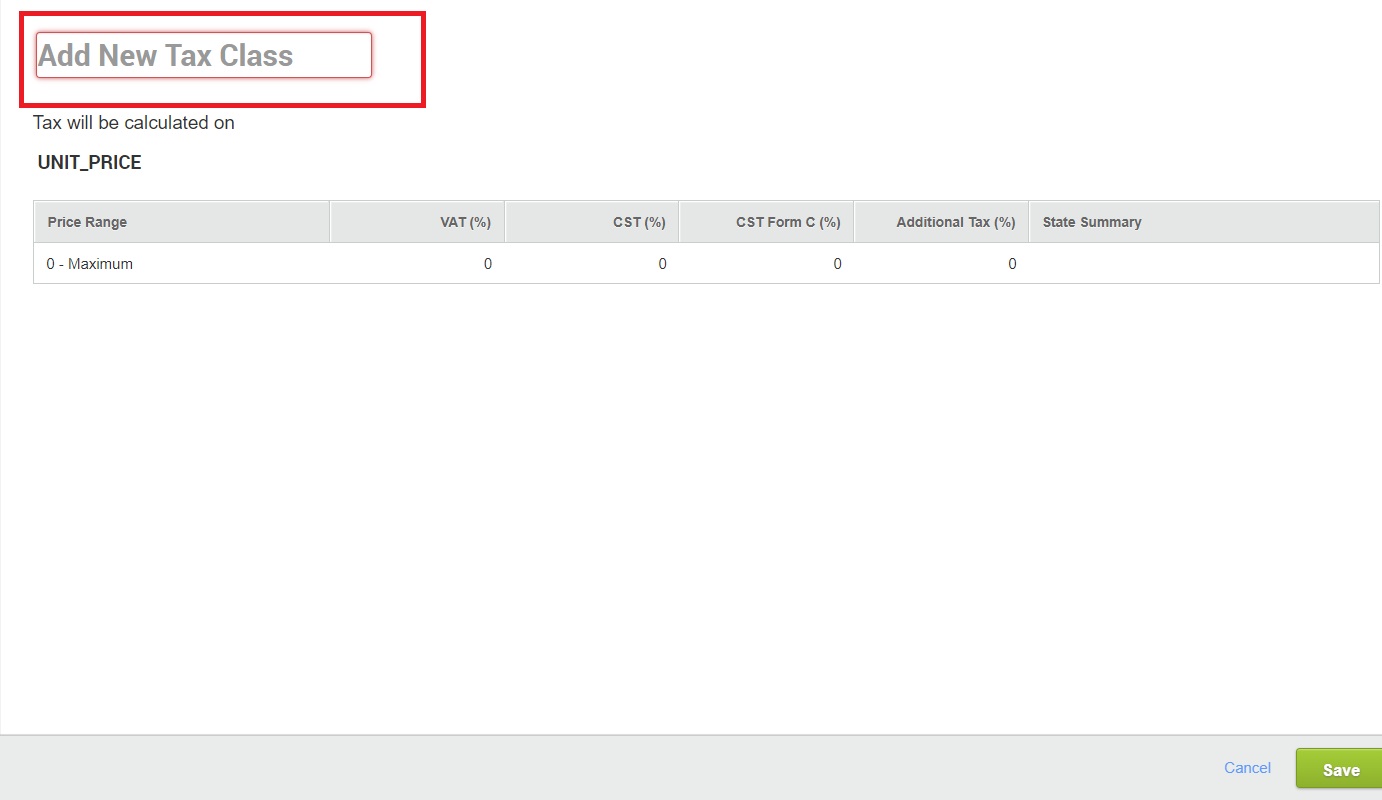

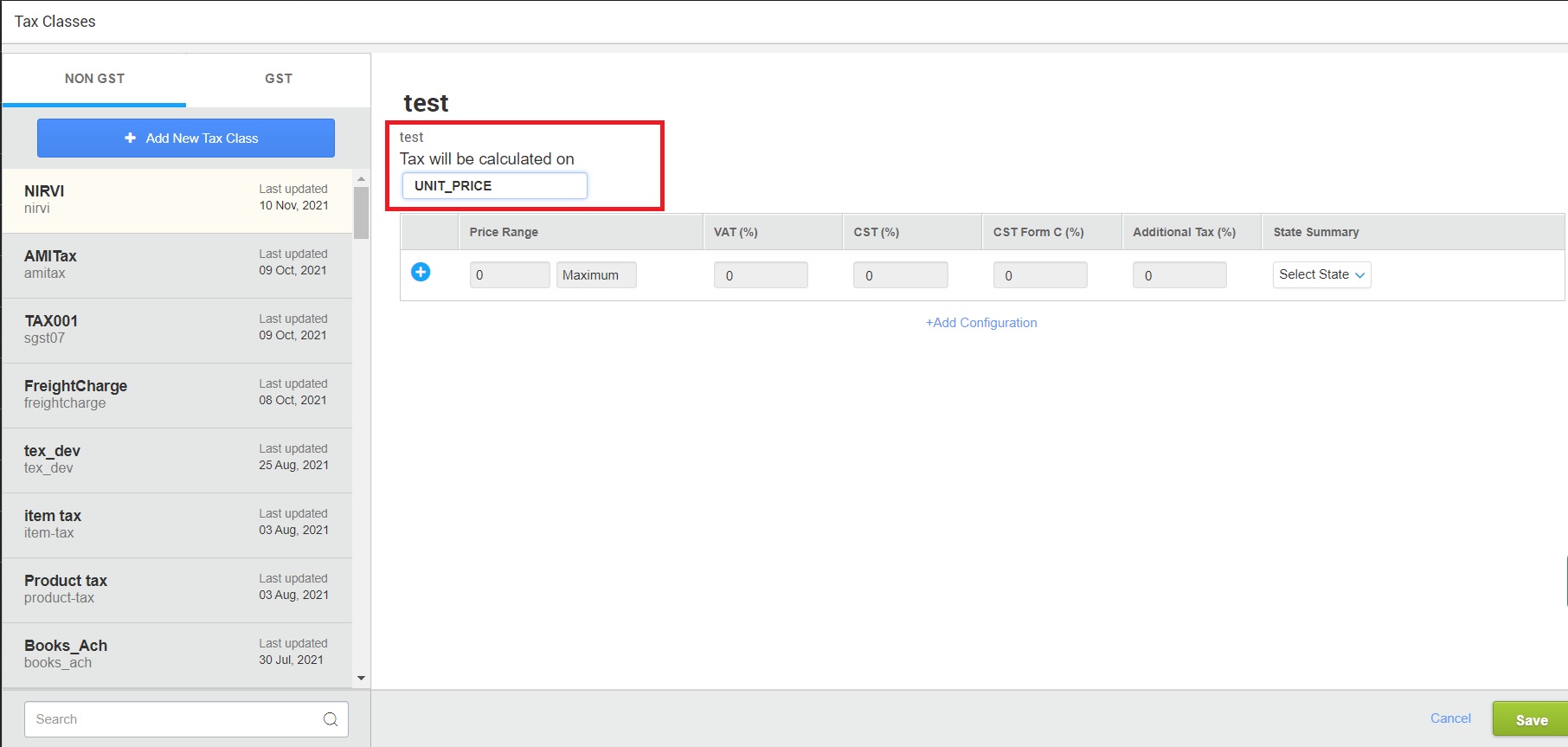

c- Give a valid name to the tax class, it can be an alphanumeric value, with a character limit of 45.

Select > Tax will be calculated on Unit Price / MRP

The default will be Unit_Price calculation.

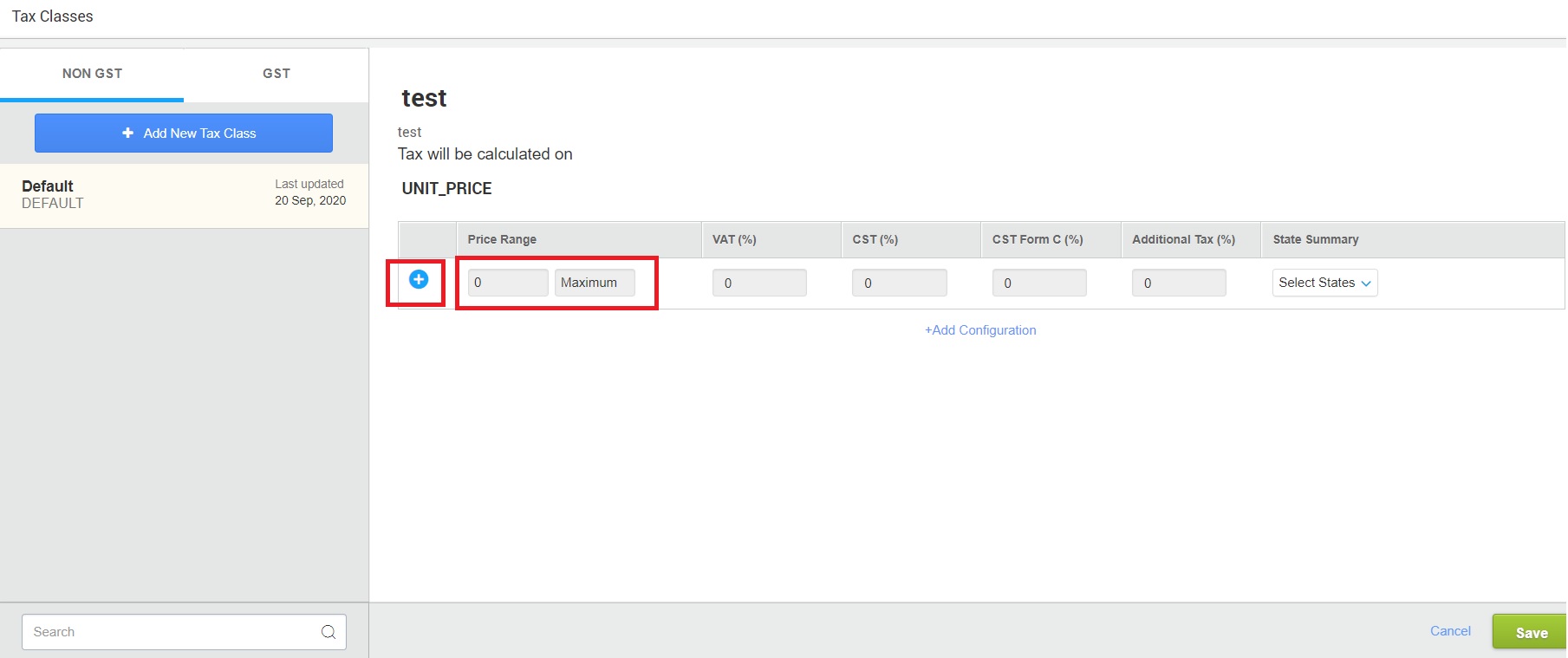

3-a)Click on the “+” sign to add a New Tax price range.

b)Define the tax percentages for VAT (%) ,CST (%) ,CST Form C (%) ,Additional Tax (%),State Summary and save the values.

Update VAT Code on Products:

Do it in below three ways for your Products:

-

Add Tax Type Code for a new product:

-

Add Tax Type Code for an existing product:

-

Add/update Tax type Code for new/existing products in bulk:

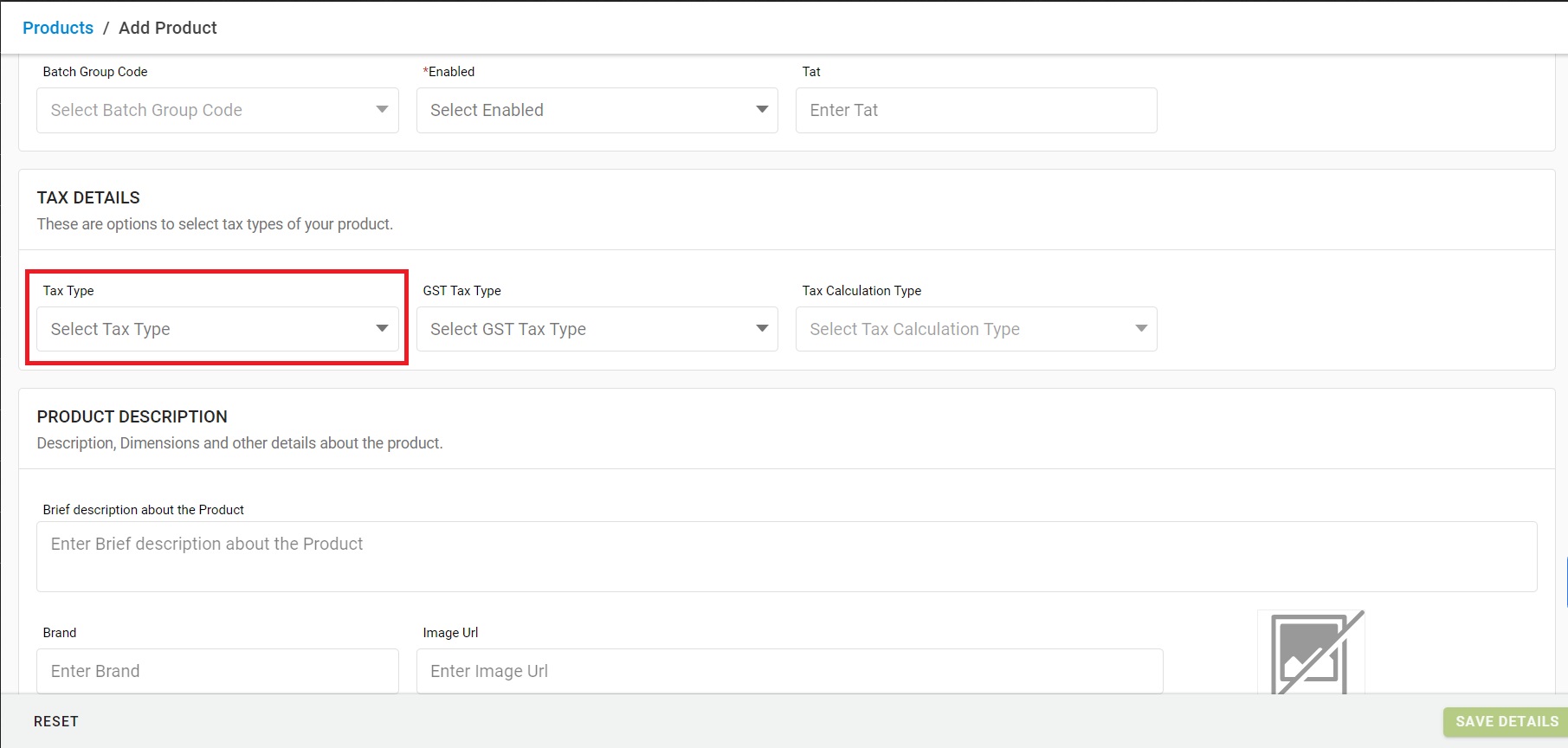

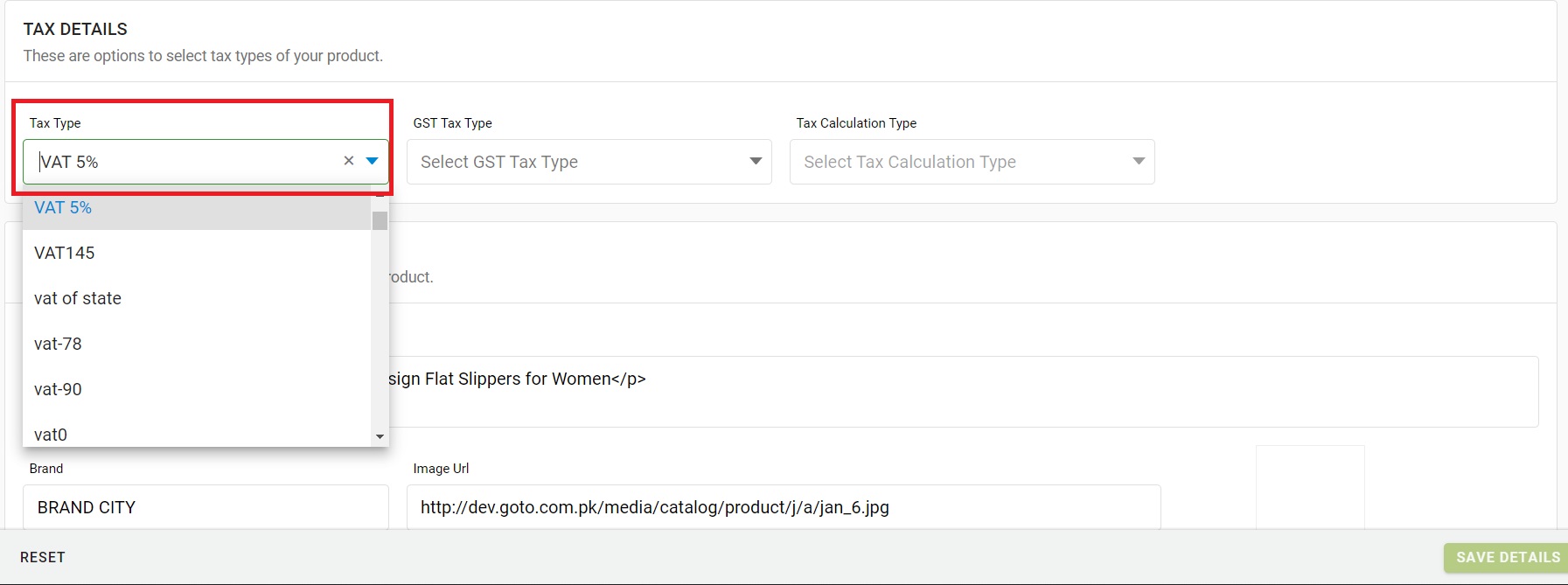

A- Add Tax Type Code for a new product:

1- Go-To Products> Add Product

2- Under General details, you will get an option to add/update TAX TYPE for new/existing products.

Define the value and save.

B- Add Tax Type Code for an existing product:

1- Go To Products> Enabled> Open Product

2-Under General details, Click EDIT> Update Tax type > Save

C- Add/update Tax type Code for new/existing products in bulk:

1- Go To Tools> Imports> Item Master> Create New and Update existing> Download CSV Format

2- Fill the CSV file with Mandatory Columns values including details in Tax Type Code column.

To know more about Item Master and how do we add/update an item master, Click here