By now, you must have got yourself registered for GST and must have got your GSTIN- Goods and Services Tax Identification Number, which mandatorily needs to be updated in Uniware so as to reflect same on every Invoice you generate from here.

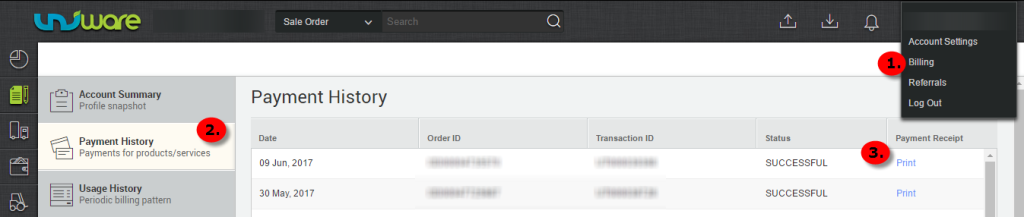

Also, Uniware GSTIN will reflect in payment receipt generated under Payment history (Billing Settings).

Below mentioned are the fields where you need to update the GSTIN in Uniware:

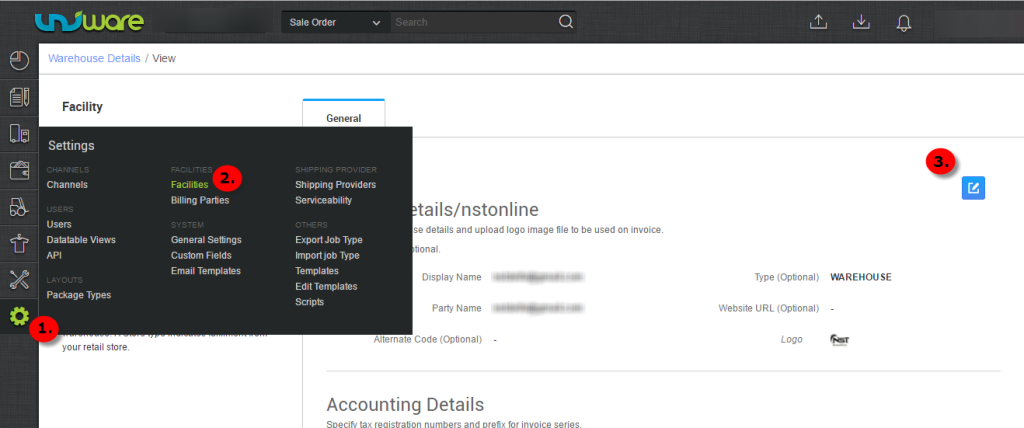

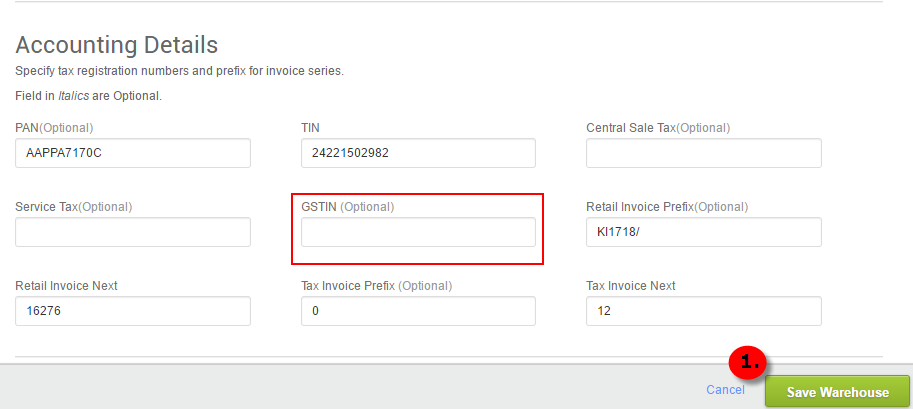

A- Update GSTIN in Facility (To know how to add a new facility, Click here)-

Follow below path:

Go to Settings> Facilities > Open It (in case of more than one facility)> Edit Facility

Check Field “GSTIN ” under Accounting Details >Update Same> Save

B- Update GSTIN in Billing Party (Only if you have added one, To know what is Billing Party and how do we set one Click here)-

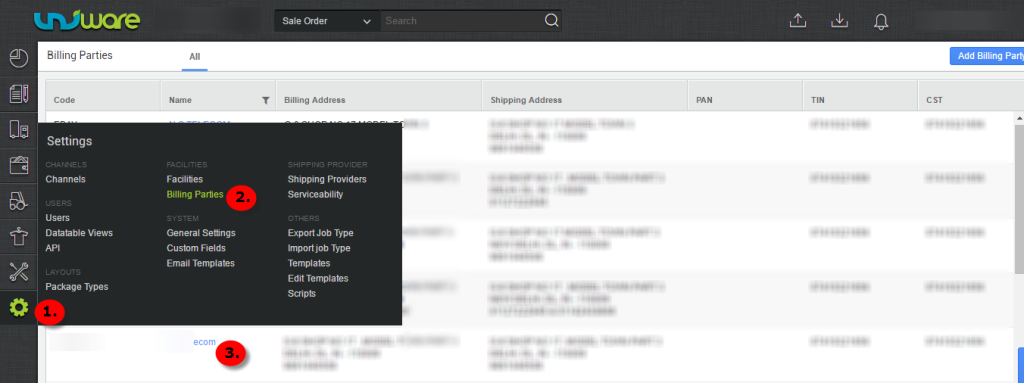

Follow below path:

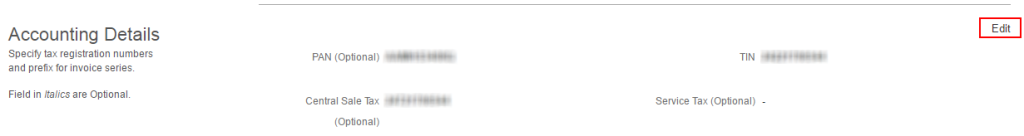

Go to Settings> Billing Parties> Open it (in case of more than one Billing Party)

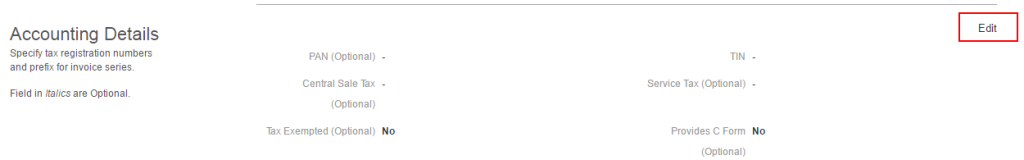

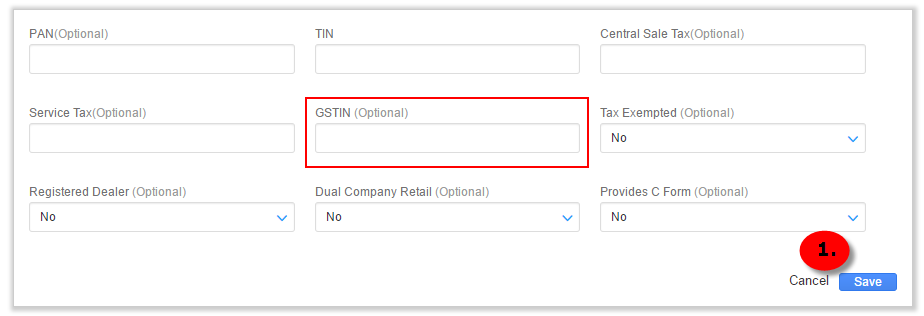

Click the EDIT button on the extreme right of Accounting Details, after you open the Billing Party.

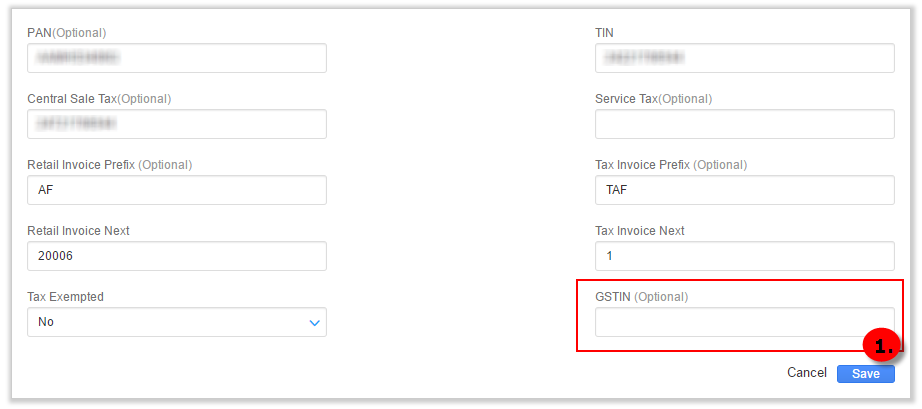

Check Field “GSTIN ” >Update Same> Save

C- Update GSTIN in Customer (Only if added, To know what is a customer and how do we add one, Click here)-

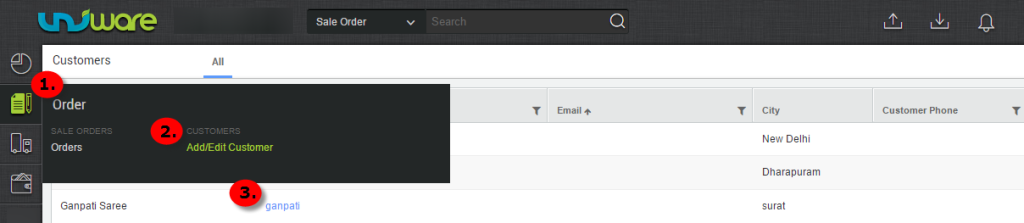

Follow below path:

Go to Orders> Add/Edit Customer> Open Customer

Click the EDIT button on the extreme right of Accounting Details, after you open the Customer.

Check Field “GSTIN ” > Update Same > Save

For Clients Using Professional Version:

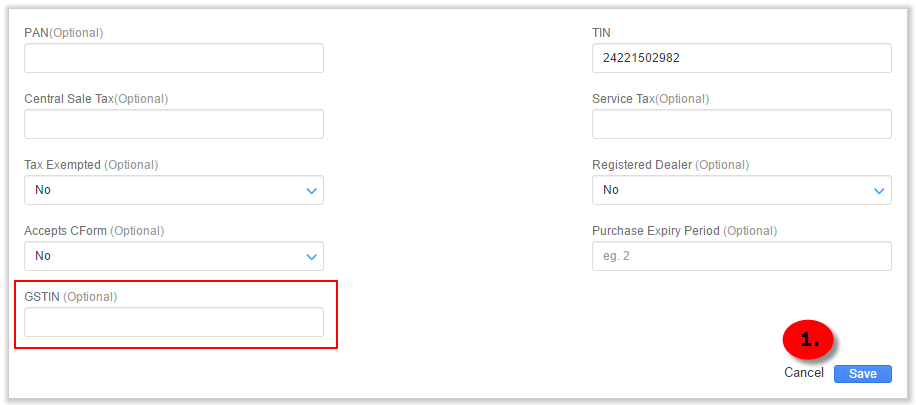

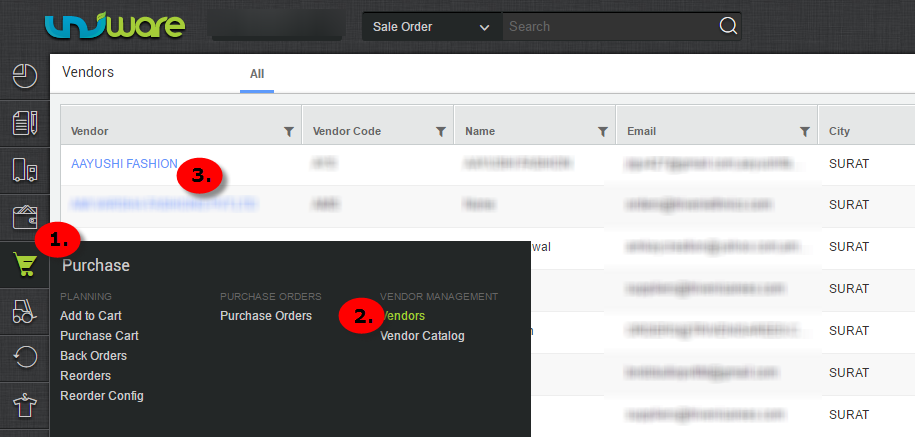

D- Update GSTIN in Vendor (Only if added, to know what is a Vendor and how do we add one in Uniware, Click here)-

Follow below Path:

Go To Purchase> Vendors> Open It

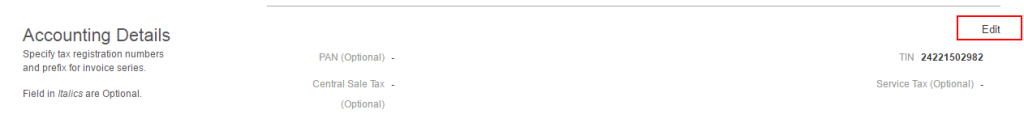

Click the EDIT button on the extreme right of Accounting Details, after you open the Vendor.

Check Field “GSTIN ” > Update Same > Save