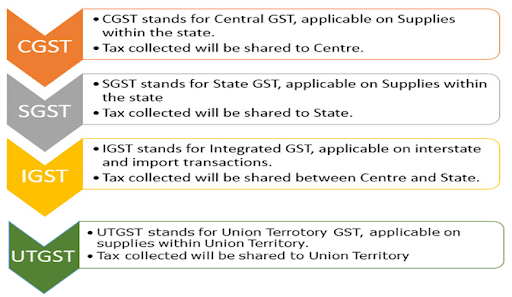

Introduction of Goods and Services Tax (GST) has replaced VAT, CST and all other indirect taxes levied on goods and services by the Central and state governments with Uniform Tax throughout the country to mark the evolution of a common national market.

Below are the components of GST:

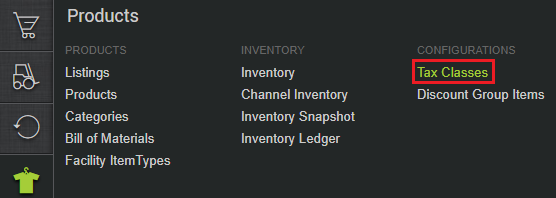

Please follow below steps to Add GST Tax Class in Uniware:

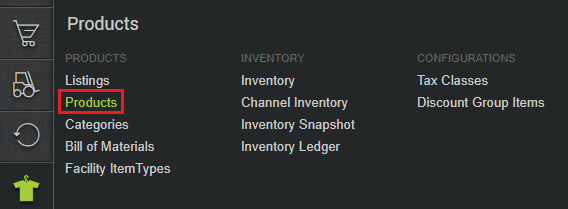

1. On the path go to Products > Tax Classes:

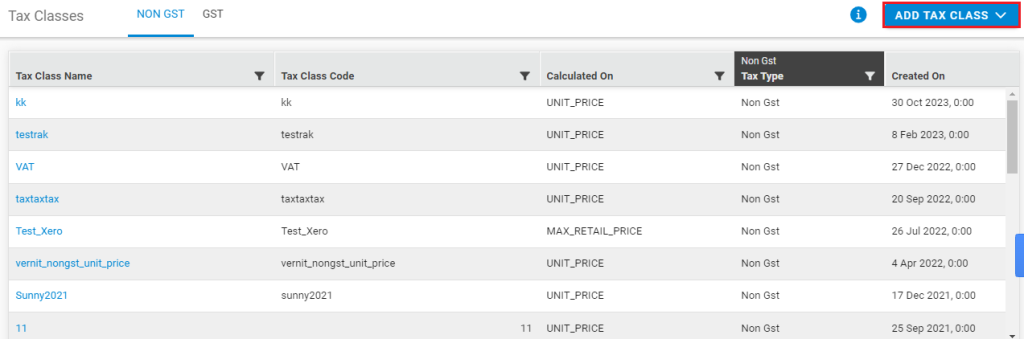

2. follow the below path

a- Click on GST tab (the Non-GST tax tab is the old taxes updated in Uniware).

b- Click on Add new Tax Class.

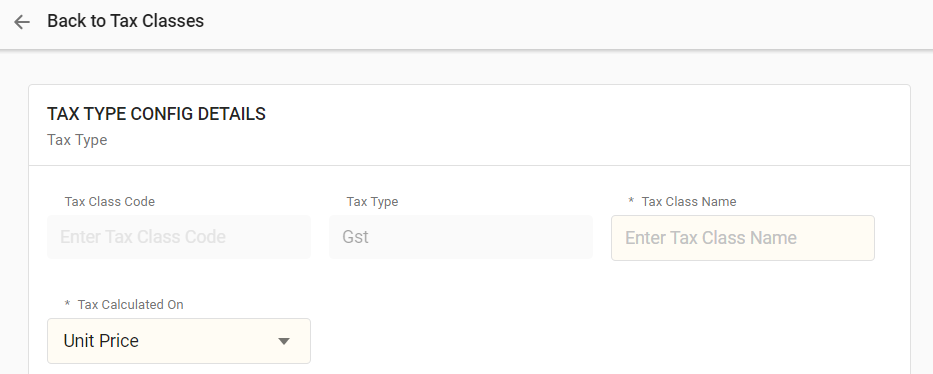

c- Give a valid name to the tax class, it can be an alphanumeric value, with a character limit of 45.

Select > Tax will be calculated on Unit Price / MRP

Default will be Unit Price calculation.

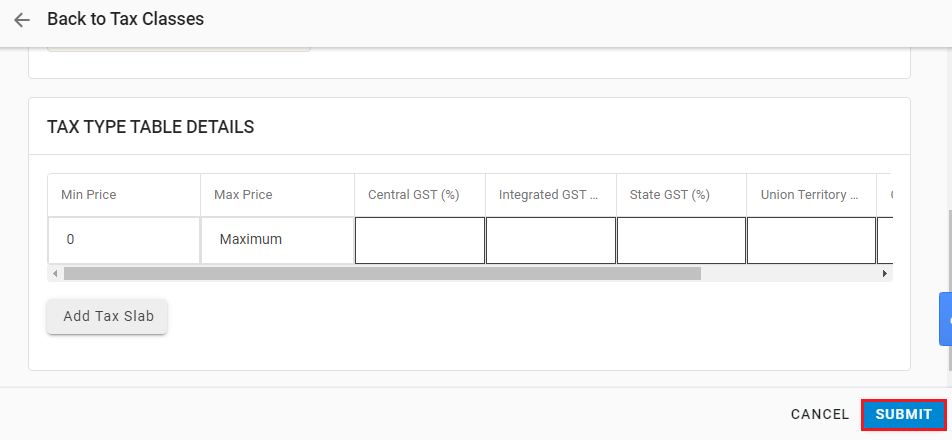

3- Define the tax percentages for CGST, IGST, STGST, UTGST and Compensation Cess and save the values.

Update GST Tax Code on Products:

Do it in below three ways for your Products:

-

Add GST Tax Type Code for a new product:

-

Add GST Tax Type Code for an existing product:

-

Add/update GST Tax type Code for new/existing products in bulk:

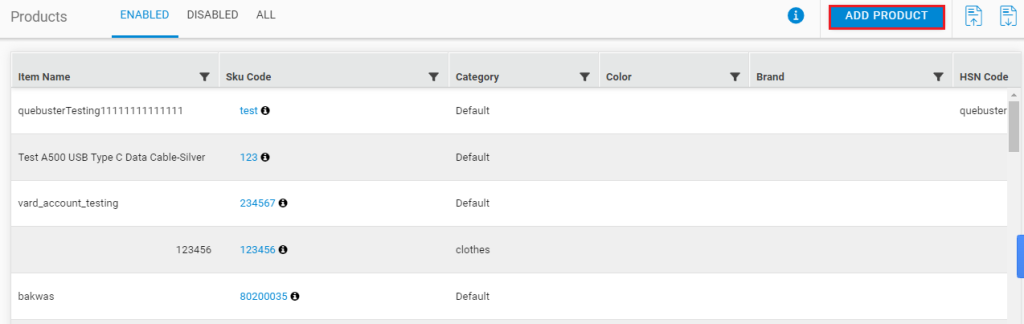

A- Add GST Tax Type Code for a new product:

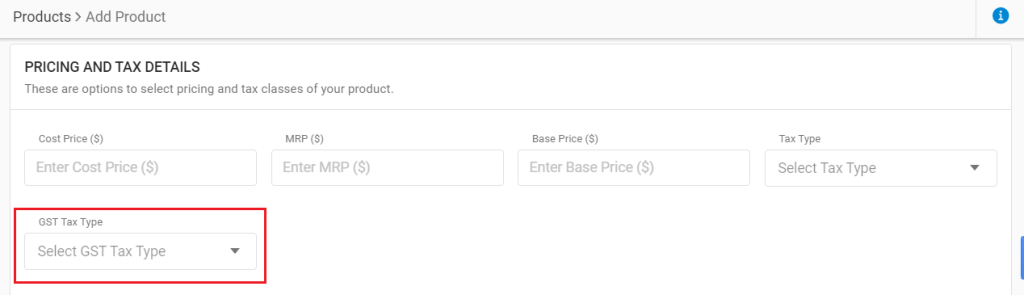

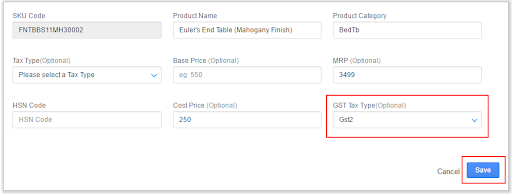

1- Go To Products> Add Product

2- Under General details, you will get an option to add/update GST TAX TYPE CODE for new/existing product.

Define the value and save.

B- Add GST Tax Type Code for an existing product:

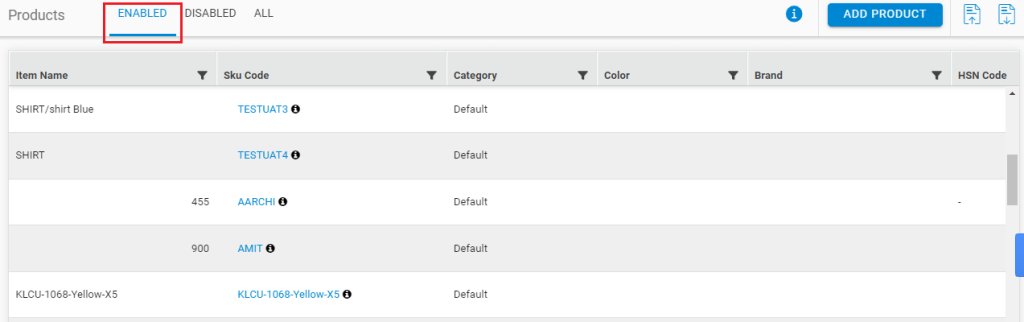

1- Go To Products> Enabled> Open Product

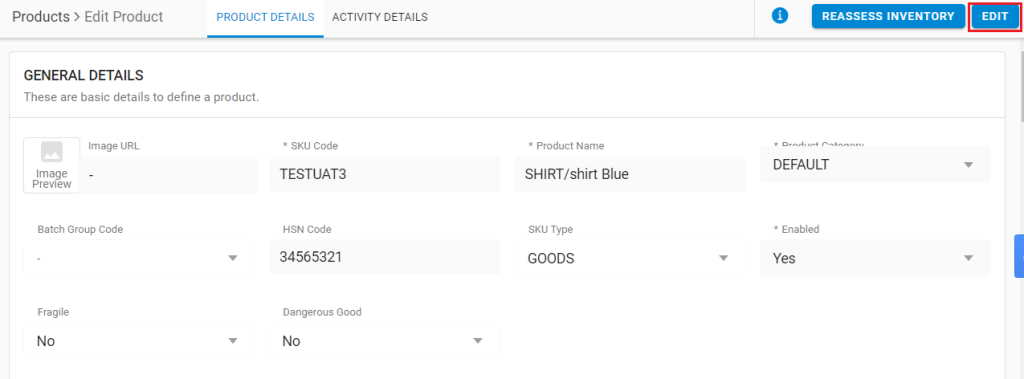

2-Under General details, Click EDIT> Update HSN code> Save

GST shipping charge tax % – For selecting Deduct Fixed GST On Shipping Charges Etc (Optional) on channel setting page as YES, then you have to edit the required tax in tax class GST_SERVICE_CHARGE.

Settings> Channels> General Settings > Deduct Fixed GST On Shipping Charges Etc (Optional)

Also define tax class on Products as, GST_SERVICE_CHARGE

C- Add/update GST Tax type Code for new/existing products in bulk:

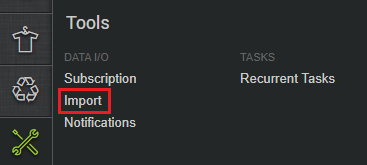

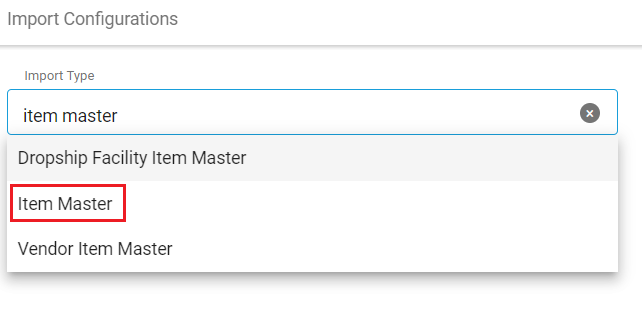

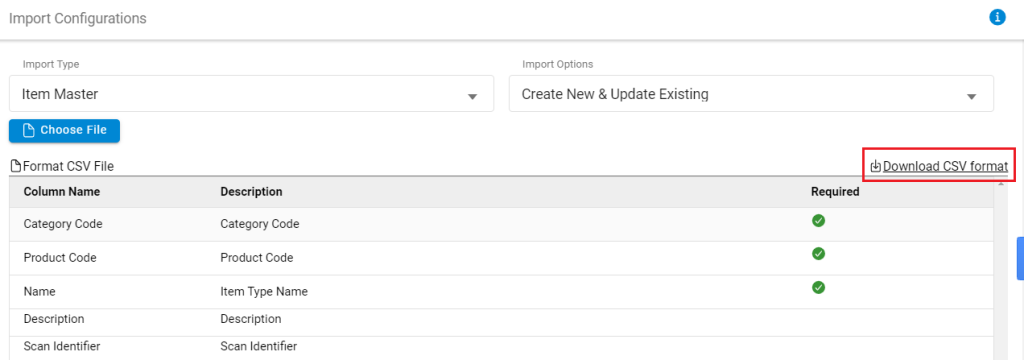

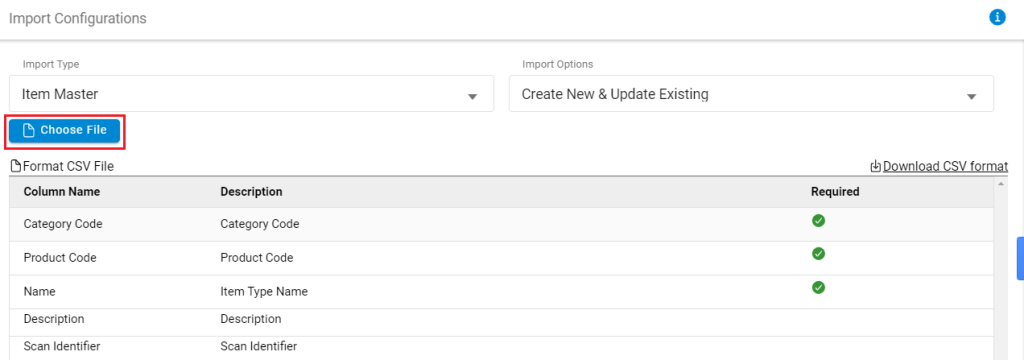

1- Go To Tools> Imports> Item Master> Create New and Update existing> Download CSV Format

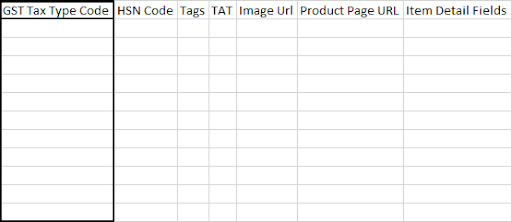

2- Fill the CSV file with Mandatory Columns values including details in GST Tax Type Code column.

To know more about Item Master and how do we add/update an item master, Click here