HSN Code is the abbreviation for Harmonized System Nomenclature.

HSN number is now adopted for classifying Goods and Service Tax (GST). Uniware allows updating and tracking of items as per their HSN number.

As per Govt. rules, HSN codes need to be updated for every product and must get reflected on Invoices for every B2B or B2C transaction.

Note: For selected Marketplace (E.g. Flipkart) HSN is mandatory under UC product(Item Master) to sync inventory on their panel.

A) You can now add HSN Codes, manually or in bulk for your products in Uniware.

-

To add HSN for a new product

-

To add HSN for an existing product

-

To add/update HSN for new/existing products in bulk

A- To add HSN for a new product

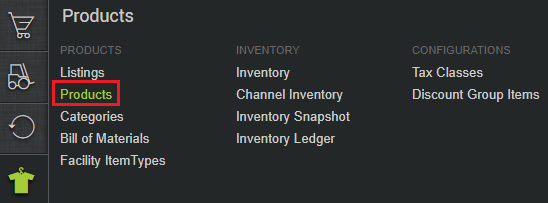

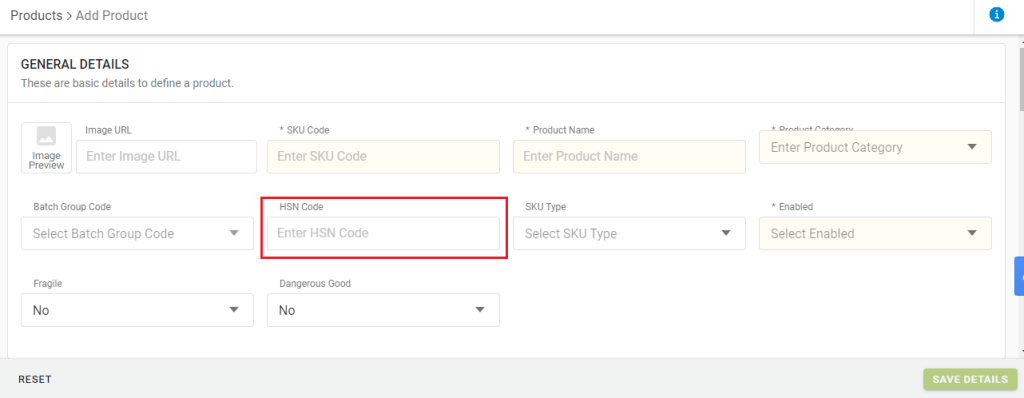

1- Go To Products> Add Product

2- Under General details, with other Mandatory fields required to add a product i.e. Category Code, Product Code, Name GST Tax Type Code*, add HSN Code as well and Save the details.

To know how to create GST TAX TYPE CODE in Uniware, Click Here

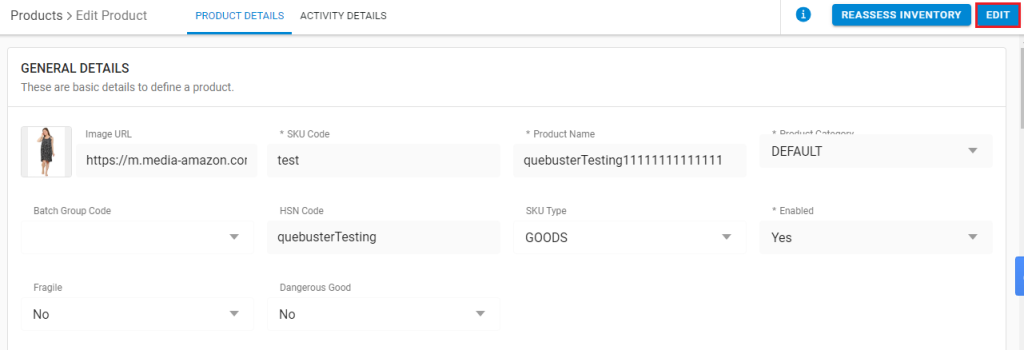

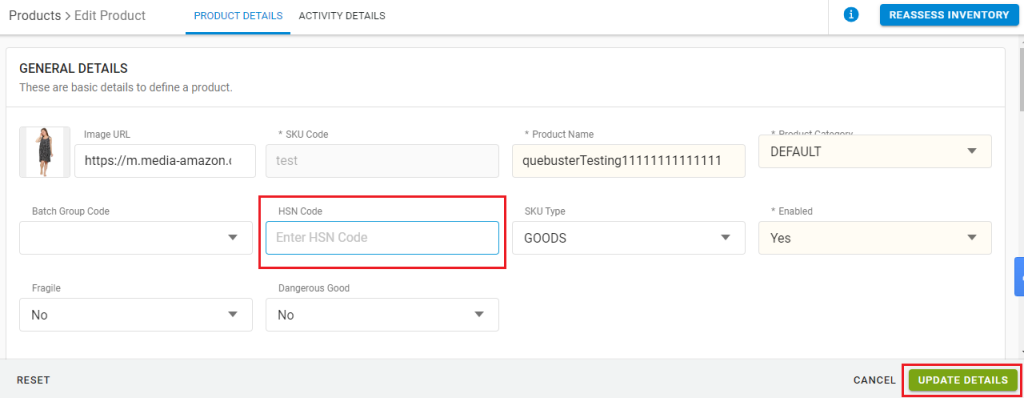

B- To add HSN for an existing product

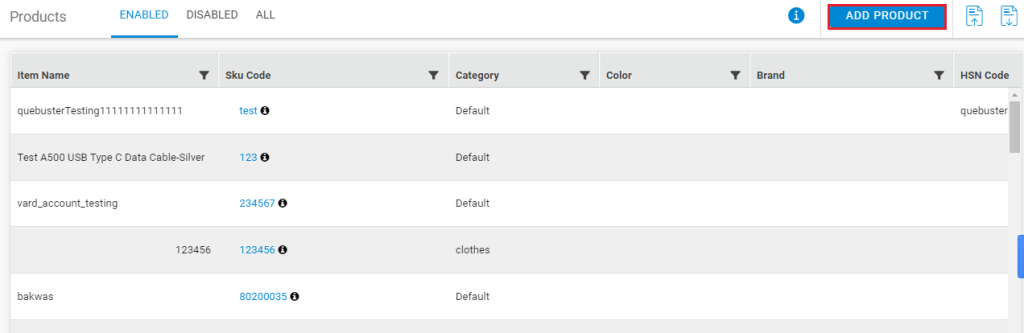

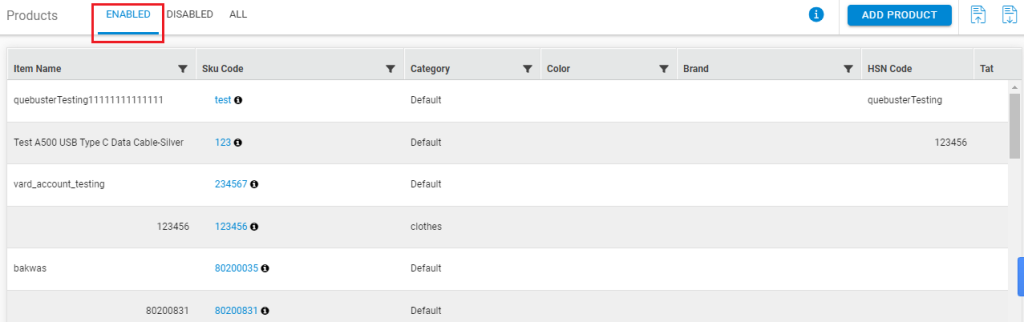

1- Go To Products> Enabled> Open Product

2- Under General details, Click EDIT> Update HSN code> Save

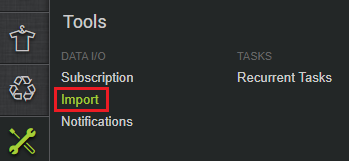

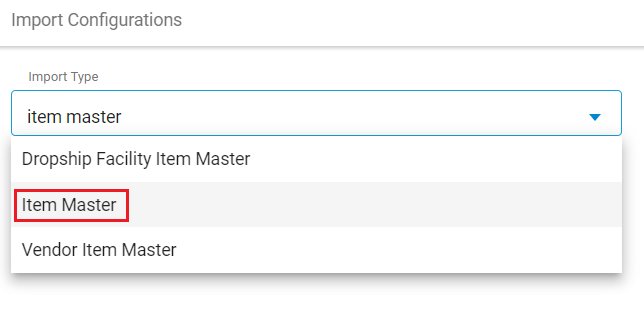

C- To add/update HSN for new/existing products in bulk:

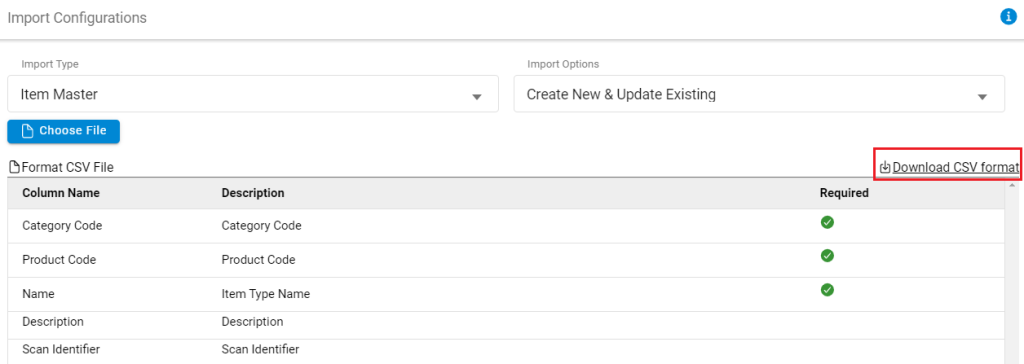

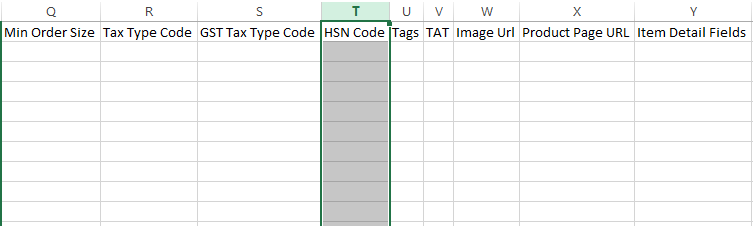

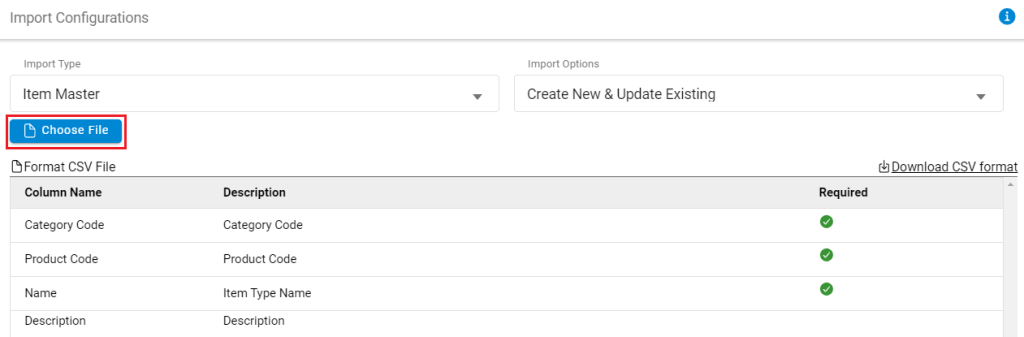

1- Go To Tools> Imports> Item Master> Create New and Update existing> Download CSV Format

2- Fill the CSV file with Mandatory Columns values including details in HSN Code column.

To know more about Item Master and how do we add/update an item master, Click here

B) Once you have updated HSN Codes in Uniware, same will be reflected on Uniware invoice (based on which invoice format is selected), Click here to know more.

Note: Keep a check on HSN which must be same everywhere to avoid any sync error as per the govt norms.

Recommended for you:

- Seamless Integrate Any Application with Tally

- Advanced Logistics Tracking and Returns Management

- E-commerce Payment Reconciliation System