Invoice Sequences for GST:

- This will work for all custom orders and channels where uniware provides own invoice series as per you facility or billing party setting.

- The changes listed below are for both Facilities (warehouses) and Billing Parties.

- For MarketPlaces like Flipkart, Amazon, Snapdeal, Nykaa and more, we will sync the invoice series from there channel as before we do. you no need to worry for it.

-

According to the GST Invoice format and rules shared by the Indian Government gst-invoice-format-rules, all invoice prefixes can contain alphabets or numerals or special characters hyphen (dash) and slash symbolized as “–” and “/” respectively, and any combination thereof. All other special characters are not allowed.

Note: The changes can be done for both Facilities (warehouses) and Billing Parties.

A- For facilities

B- For Billing Parties

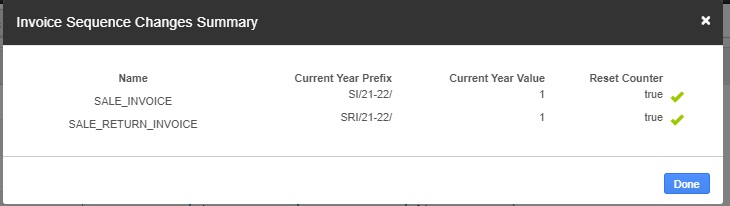

For new financial year sale/return invoice series change, we have a different process for more details Click Here.

Follow the steps, if you wish to update the invoice series:

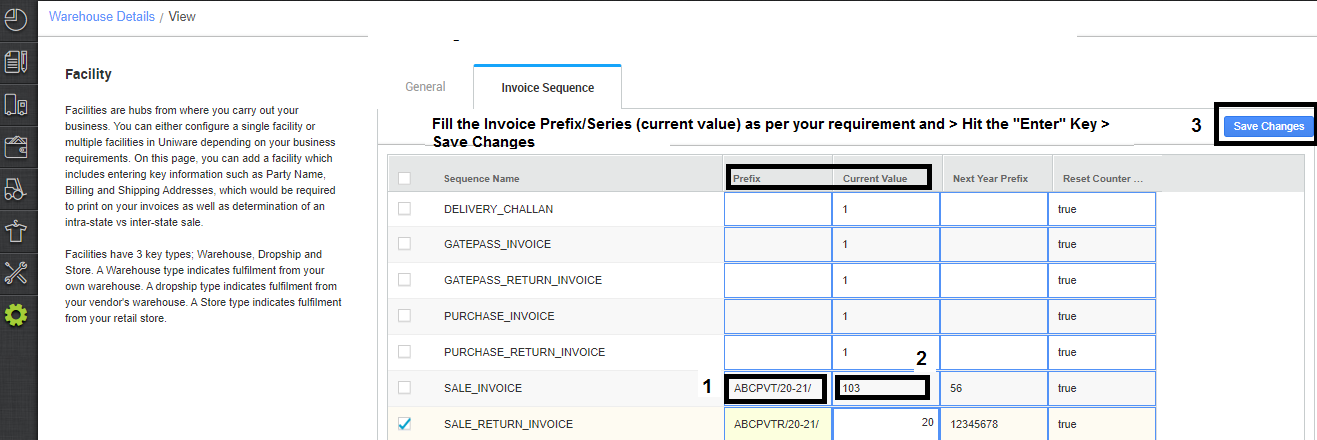

A- For facilities

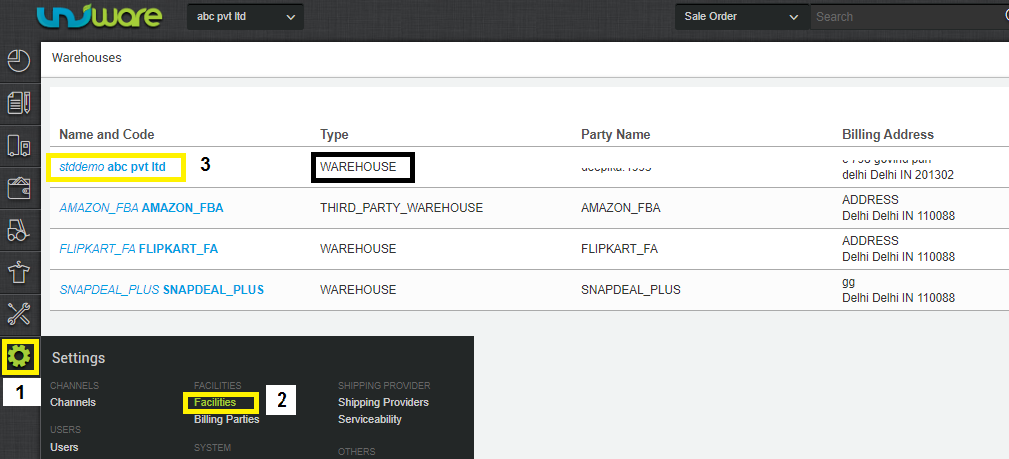

1- Go to Setting > Facilities> Click on main Warehouse name code > Invoice Sequences.

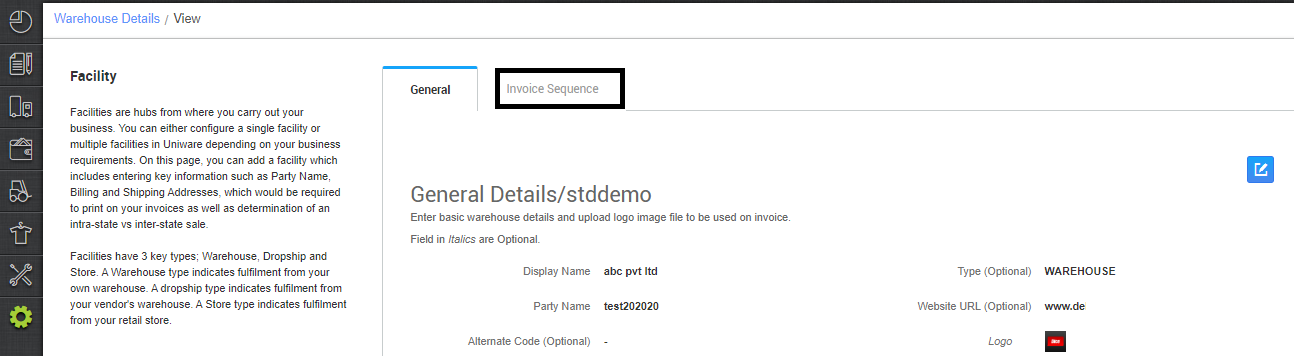

1.a) Open Invoice Sequence

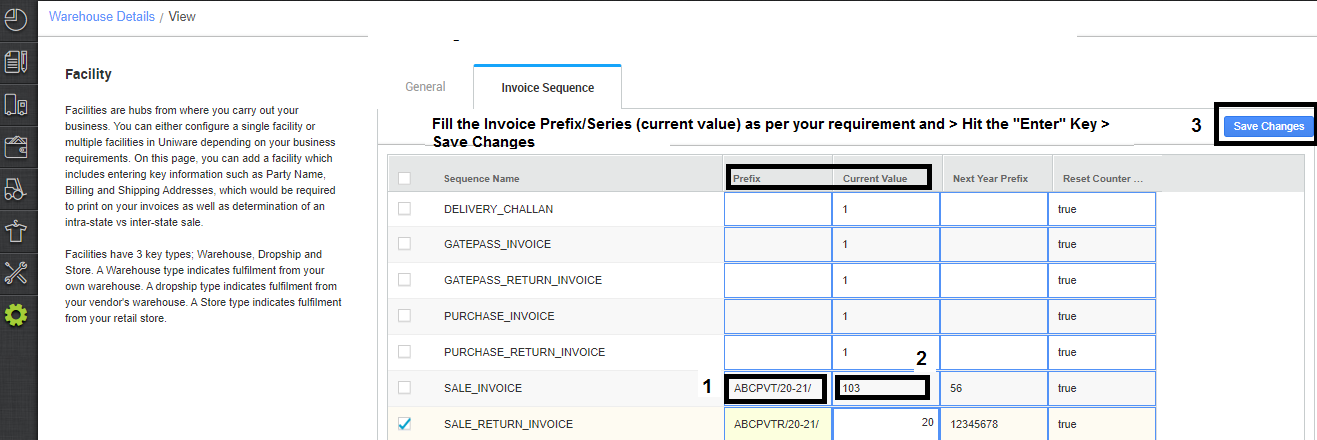

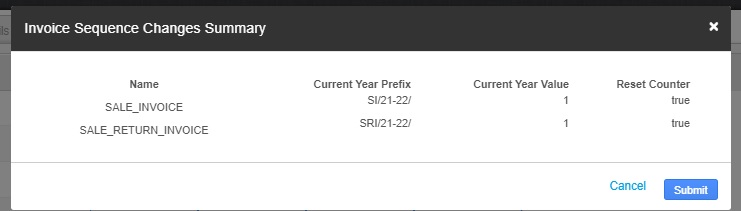

1.b) Fill the Invoice Prefix/Series (current value) as per your requirement and > Hit the “Enter” Key > Save Changes > Submit > Done.

-

If you want your invoice sequence to look like SR/2021/22/00001 then SR/2021/22/00002 and so on then use the first part SR/2021/22/ in Prefix to create the prefix and use 00001 in the counter.

-

The incremental number 0001 under counter, will only increase as soon as the invoice is generated.

-

Sequence counters can only increase to the next value that cannot be rolled back, so check the series counter before saving.

-

The prefixes should be unique for each sequence also in the billing party to avoid operational issues.

Now we explain the significance of each series to be set under Invoice Sequences:

SALE_INVOICE- Invoice generated at the time of supply of taxable goods/services.

SALE_RETURN_INVOICE– Invoice generated against putaway created for dispatched items. It will act as a credit note i.e Invoice against return of sale. {Scroll Down to see the process to generate SALE_RETURN_INVOICE }

PURCHASE_INVOICE– Purchase order (PO) Invoice.

PURCHASE_RETURN_INVOICE– PO is returned to vendor (RTV). Work as credit note, Invoice against return of purchase.

GATEPASS_INVOICE– Invoice created in case of any Gatepass created in the system.

GATEPASS_RETURN_INVOICE– Invoice to be generated in case of returnable Gatepass.

DELIVERY_CHALLAN– Invoice generated in case of intra-state Stock Transfer.

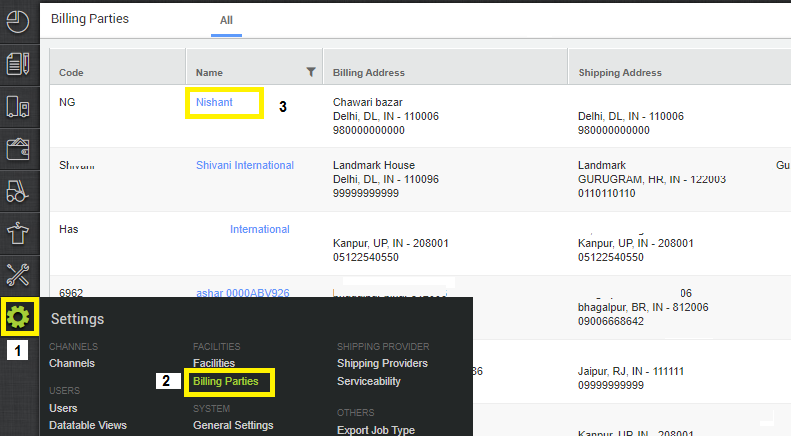

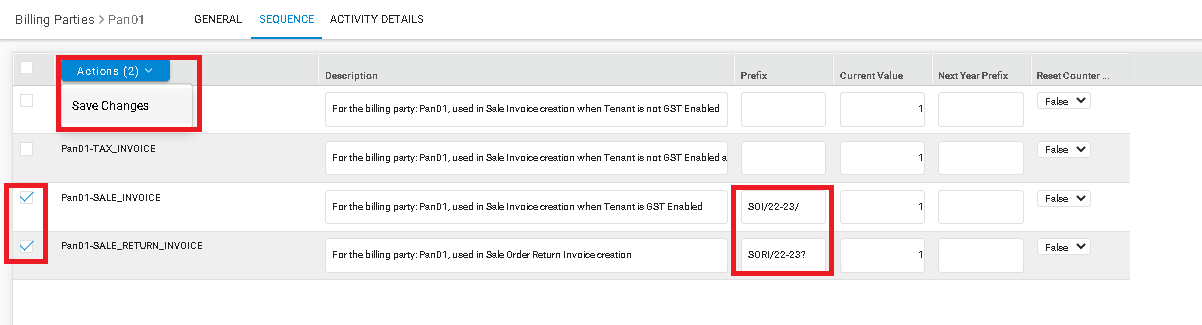

B- For Billing Parties

Similarly, mark the changes for Billing Parties, (Click here to know more)

1- Go to Setting > Billing Parties> Invoice Sequences.

Open any billing party, go to Invoice Sequence and change your prefixes for below-mentioned parameters as you check above shared step for the facility.

Keeping in mind:

- Every prefix must be different from each so that the system can save the unique series for every channel.

- The prefixes should be unique for each sequence and in the billing party to avoid invoicing issues.

- If you want your invoice sequence to look like SR/2021/22/00001 then SR/2021/22/00002 and so on then use the first part SR/2021/22/ in Prefix to create the prefix and use 00001 in the counter.

- The incremental number 0001 under counter, will only increase as soon as the invoice is generated.

- Sequence counters can only increase to the next value that cannot be rolled back, so check the series counter before saving.

- It is mandatory to keep different prefixes for the above parameters for different billing parties to avoid issues in creating invoices or operating putaway functions related to channels associated with respective billing parties in Uniware.

SALE_RETURN_INVOICE: Credit Notes

Invoice against the return of sale. Unicommerce is now providing return invoices (credit notes) for all return orders.

For this, Create Putaway received returns for Dispatched orders in Uniware Click Here

Search Order> Invoices> Against the return, an RP code will be generated and you can print the Invoice against the same with Invoice series as set in FACILITIES/BILLING PARTY